Legal South Carolina Transfer-on-Death Deed Form

Dos and Don'ts

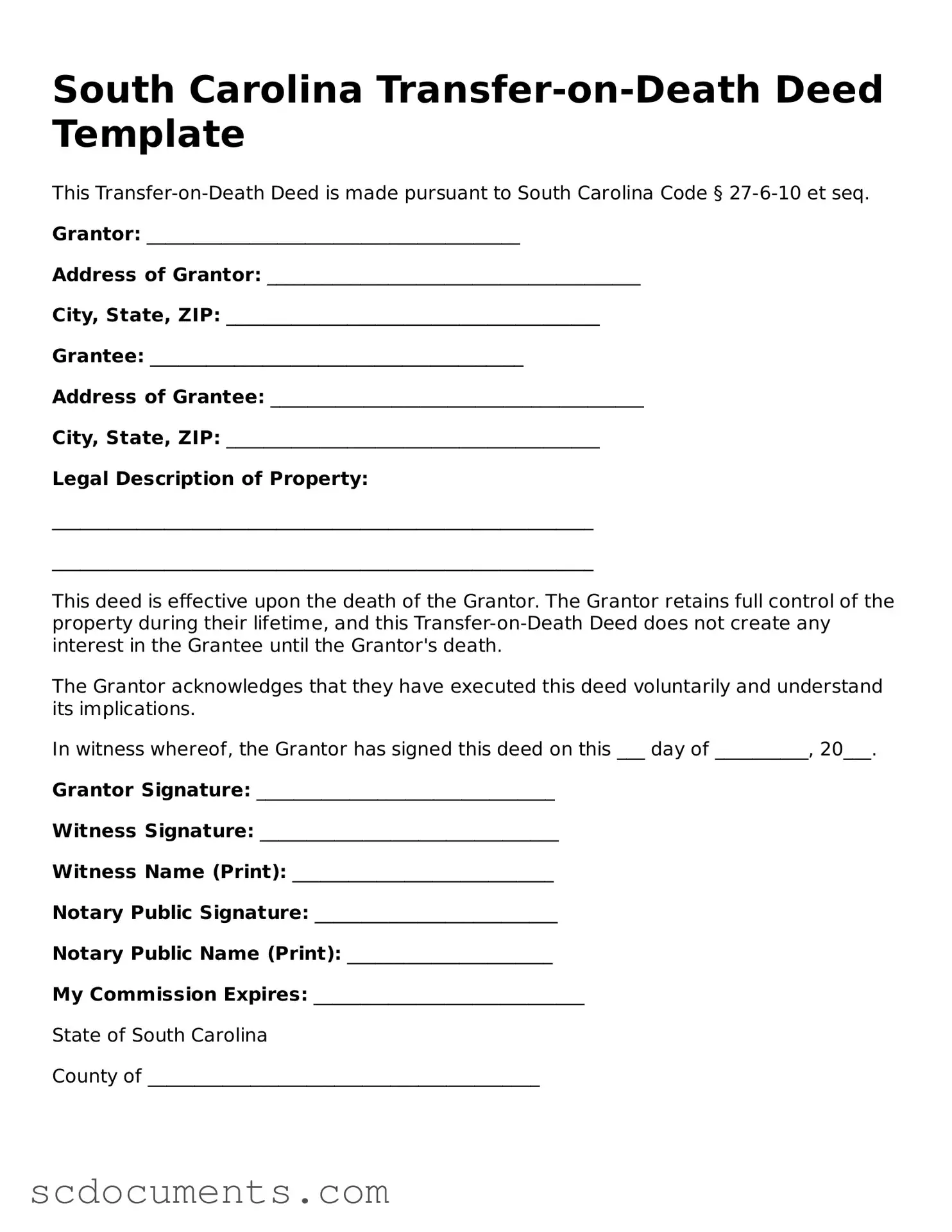

When filling out the South Carolina Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of things to do and avoid:

- Do read the instructions carefully before starting.

- Do provide accurate information about the property.

- Do include the full names of all parties involved.

- Do sign the deed in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't leave any required fields blank.

- Don't use abbreviations or nicknames for names.

- Don't forget to check for any local recording requirements.

- Don't rush the process; take your time to ensure accuracy.

- Don't submit the deed without proper notarization.

File Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in South Carolina to transfer real estate to beneficiaries upon their death, avoiding probate. |

| Governing Law | The use of Transfer-on-Death Deeds in South Carolina is governed by South Carolina Code § 27-6-10 to § 27-6-30. |

| Requirements | The deed must be signed by the property owner and must be recorded in the county where the property is located to be effective. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time by executing a new deed or a formal revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them as specified in the deed. |

Documents used along the form

When considering the South Carolina Transfer-on-Death Deed, it's essential to understand that it often works in conjunction with several other important documents. Each of these forms plays a vital role in ensuring that property is transferred smoothly and according to your wishes. Below is a list of commonly used documents that you may encounter alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how you want your assets distributed after your death. It can include specific bequests and appoint an executor to manage your estate.

- Living Trust: A living trust allows you to place your assets into a trust during your lifetime. This can help avoid probate and ensure a smoother transfer of assets to your beneficiaries.

- Durable Power of Attorney: This form gives someone the authority to make financial decisions on your behalf if you become incapacitated. It's crucial for managing your affairs when you're unable to do so.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document designates someone to make medical decisions for you if you are unable to express your wishes.

- Missouri 5177 Form: This form is crucial for correcting or completing information on a vehicle title or certificate of ownership. For assistance with the process, you can refer to All Missouri Forms.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance policies and retirement accounts. They specify who will receive the benefits upon your death, overriding any wills or trusts.

- Quitclaim Deed: This document transfers ownership of property from one party to another without any guarantees. It’s often used to add or remove someone from the title of a property.

- Affidavit of Heirship: This form establishes the heirs of a deceased person and can be used to transfer property without going through probate, depending on the situation.

- Property Deed: This legal document records the ownership of real estate. It includes details about the property and the parties involved in the transaction.

- Estate Inventory Form: This document lists all assets and liabilities of the deceased. It’s an important tool for the executor to manage the estate and ensure all debts are settled before distribution.

Understanding these documents can help you navigate the complexities of estate planning. Each one serves a unique purpose, contributing to a comprehensive plan that reflects your wishes and protects your loved ones. Always consider consulting with a legal professional to ensure that everything is in order.

Key takeaways

When considering the South Carolina Transfer-on-Death Deed form, it’s important to understand its purpose and how to use it effectively. Here are some key takeaways:

- What It Is: A Transfer-on-Death Deed allows you to transfer real estate to a beneficiary upon your death without the property going through probate.

- Eligibility: Only certain types of property can be transferred using this deed, such as residential properties, but not all properties qualify.

- Filling Out the Form: Ensure that you accurately fill in the names of both the grantor (you) and the beneficiary, along with a clear description of the property.

- Witnesses and Notarization: The deed must be signed in the presence of two witnesses and a notary public to be valid.

- Recording the Deed: After completing the form, it must be recorded with the county Register of Deeds where the property is located.

- Revocation: You can revoke the deed at any time before your death by filing a revocation form or creating a new Transfer-on-Death Deed.

- Tax Implications: Transferring property through a Transfer-on-Death Deed may have tax implications, so it’s wise to consult a tax professional.

- Impact on Estate Planning: This deed can simplify your estate planning, but it should be part of a broader strategy that includes wills and trusts.

- Beneficiary Considerations: Choose your beneficiaries wisely, as they will receive the property automatically upon your death, regardless of other estate plans.

Other South Carolina Templates

Sc Title - Having a Motorcycle Bill of Sale is beneficial for tax purposes, as it serves as proof of purchase.

For those who need assistance in managing their financial or medical decisions, the Georgia Power of Attorney form can be invaluable. It is important to familiarize yourself with the details of this document to ensure that your preferences are adhered to, especially in critical situations. For further information and guidance on this matter, you can visit https://georgiapdf.com/power-of-attorney.

Is South Carolina Community Property State - Aims to prevent future litigation by documenting all agreements made.

Durable Power Printable Power of Attorney Form - You can limit the duration of the authority granted if you choose.