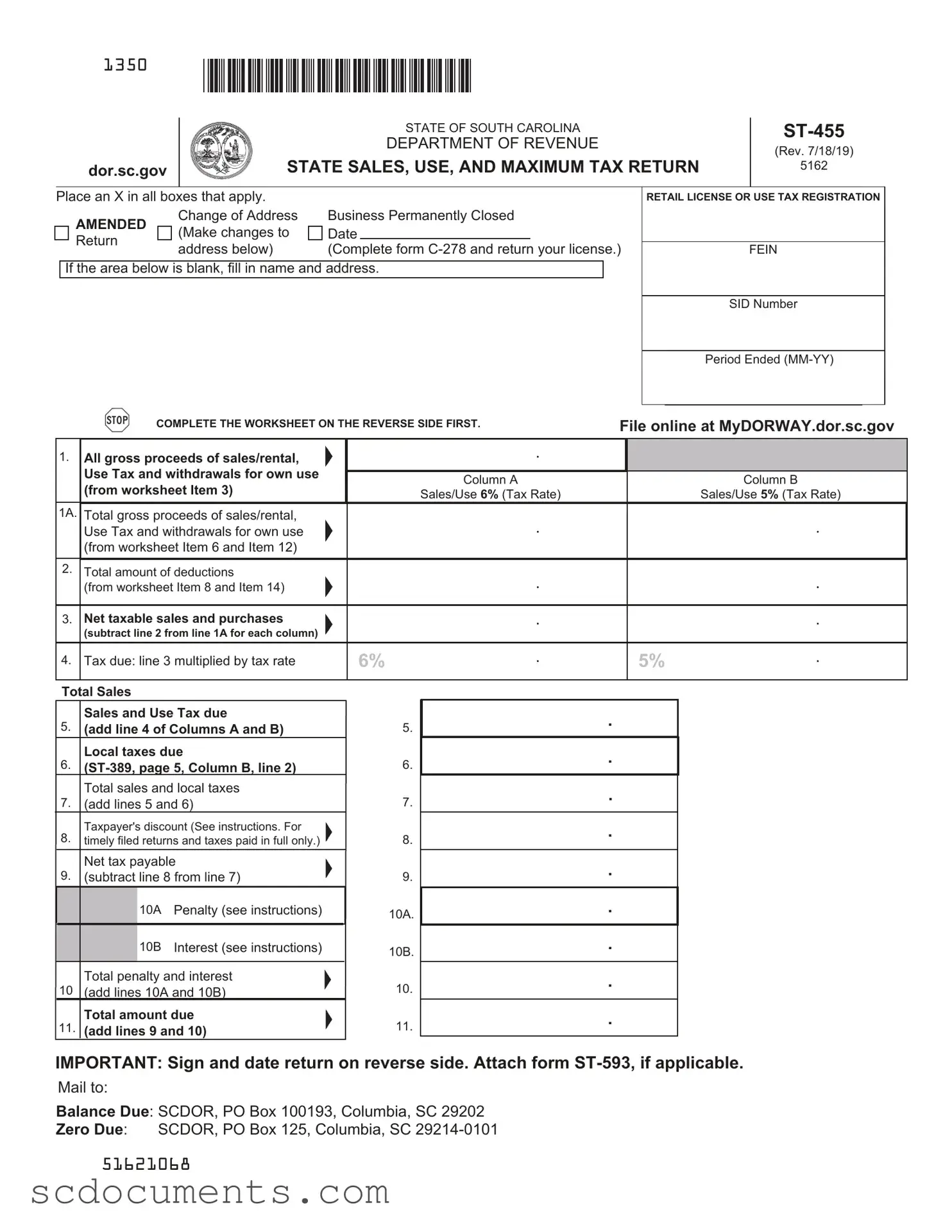

Blank State Of South Carolina St455 Template

Dos and Don'ts

When filling out the State of South Carolina ST-455 form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should do and five things you should avoid.

- Do complete the worksheet on the reverse side before filling out the front of the form.

- Do provide accurate information for all gross proceeds of sales, rentals, and withdrawals.

- Do sign and date the return to validate your submission.

- Do attach form ST-593 if it is applicable to your situation.

- Do mail the completed form to the correct address based on whether you owe a balance or have a zero due.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to double-check your calculations to avoid errors.

- Don't submit the form after the 20th day of the month following the close of the period, as it will be considered delinquent.

- Don't ignore local tax requirements, as they may apply even if state sales tax does not.

- Don't use outdated forms; ensure you are using the most current version of the ST-455 form.

File Attributes

| Fact Name | Details |

|---|---|

| Form Title | State Sales, Use, and Maximum Tax Return |

| Form Number | ST-455 |

| Governing Law | South Carolina Code of Laws, Title 12, Chapter 36 |

| Filing Frequency | Monthly, quarterly, or annually, depending on business volume. |

| Online Filing | Returns can be filed online at MyDORWAY.dor.sc.gov. |

| Deadline for Filing | Returns are due on the 20th day of the month following the reporting period. |

| Penalty for Late Filing | Late returns may incur penalties and interest as specified in the instructions. |

| Exemptions | Sales of unprepared foods are exempt from state sales tax but may be subject to local taxes. |

| Where to Mail | Mail to SCDOR, PO Box 100193, Columbia, SC 29202 for balance due; PO Box 125, Columbia, SC 29214-0101 for zero due. |

| Signature Requirement | The return must be signed and dated on the reverse side. |

Documents used along the form

The State of South Carolina ST-455 form is an essential document for reporting sales and use tax. When completing this form, several other documents may also be required to ensure compliance with state tax regulations. Below are four commonly used forms that often accompany the ST-455.

- Form C-278: This form is used to notify the South Carolina Department of Revenue when a business is permanently closed. It ensures that the business’s tax obligations are settled and that the retail license is updated accordingly.

- Form ST-593: This form is an attachment that may be required if there are specific deductions or exemptions related to sales and use tax. It provides detailed information about the deductions claimed on the ST-455.

- Employee Handbook Form: For a well-structured workplace, consider the helpful employee handbook resources to guide your company policies and employee expectations.

- Form ST-389: This worksheet is used to report local taxes applicable to sales. It helps in calculating the total local taxes due, which must be reported alongside the state sales and use tax on the ST-455.

- Sales and Use Tax Worksheets: These worksheets help in calculating gross proceeds, deductions, and net taxable sales. They guide taxpayers in accurately reporting their sales and use tax obligations on the ST-455.

Understanding these accompanying forms can simplify the process of filing the ST-455 and ensure that all tax obligations are met accurately. It is crucial to complete all relevant documents thoroughly to avoid potential issues with the South Carolina Department of Revenue.

Key takeaways

When filling out and using the State of South Carolina ST-455 form, consider the following key takeaways:

- Understanding the Purpose: The ST-455 form is used to report sales, use, and maximum tax returns in South Carolina. It is essential for both businesses and individuals who engage in taxable sales or purchases.

- Completing the Worksheet: Before filling out the ST-455 form, complete the worksheet on the reverse side. This step is crucial for accurately calculating gross proceeds, deductions, and net taxable sales.

- Timely Submission: The return is considered delinquent if postmarked after the 20th day of the month following the close of the reporting period. Timely filing helps avoid penalties and interest.

- Local Taxes: Be aware that local taxes may apply to certain sales. If local tax is applicable, it must be reported on the ST-389 worksheet and included in the total tax calculations.

- Signature Requirement: The form must be signed and dated by the taxpayer. This certification confirms the accuracy of the information provided and is a legal requirement for submission.

Create Other PDFs

Online Cna Classes South Carolina - Use only black or blue ink to complete the form.

Completing the Missouri Affidavit of Gift form is essential for anyone looking to make a significant gift while ensuring that their intentions are legally recognized. This vital document not only affirms that the property is given without compensation but also helps clarify any potential tax liabilities. For a comprehensive overview and access to the necessary documentation, visit All Missouri Forms.

South Carolina Real Estate Law - The sale may or may not be contingent on the property appraising for the agreed-upon price.