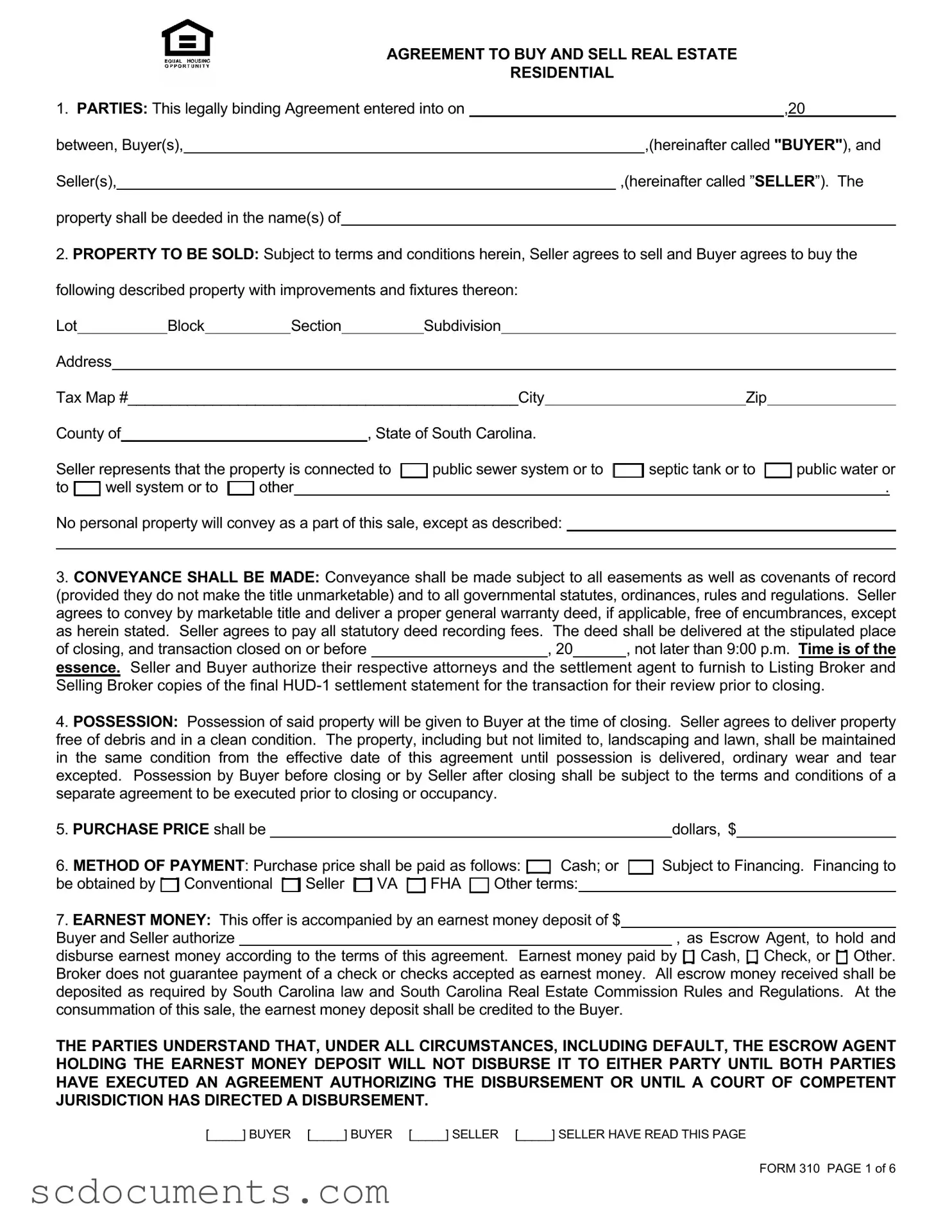

Blank South Carolina Real Estate Contract 310 Template

Dos and Don'ts

Do's when filling out the South Carolina Real Estate Contract 310 form:

- Clearly identify the parties involved in the transaction.

- Provide accurate property details, including address and tax map number.

- Specify the purchase price and payment method.

- Include any earnest money deposit details.

- Ensure all contingencies are clearly stated and understood.

Don'ts when filling out the South Carolina Real Estate Contract 310 form:

- Do not leave any sections blank that require information.

- Avoid using vague terms; be specific in descriptions.

- Do not forget to include deadlines for loan approval and inspections.

- Do not neglect to read and understand all terms before signing.

- Do not assume any repairs will be made without written agreement.

File Attributes

| Fact Name | Details |

|---|---|

| Parties Involved | The contract is between the Buyer(s) and Seller(s), clearly identifying each party's role in the transaction. |

| Property Description | The contract requires a detailed description of the property being sold, including address and tax map number. |

| Earnest Money | An earnest money deposit is required and must be held by an escrow agent until the transaction is completed or terminated. |

| Possession Timing | Possession of the property is typically granted to the Buyer at closing, ensuring a smooth transition of ownership. |

| Closing Costs | Closing costs are divided between the Buyer and Seller, with specific responsibilities outlined for each party. |

| Governing Law | This contract is governed by the laws of South Carolina, specifically the South Carolina Code of Laws. |

Documents used along the form

The South Carolina Real Estate Contract 310 form serves as a crucial document in real estate transactions within the state. However, several other forms and documents often accompany this contract to facilitate various aspects of the sale. Below is a list of commonly used documents that may be required or recommended alongside the South Carolina Real Estate Contract 310.

- Seller's Property Condition Disclosure Statement: This document provides buyers with information about the condition of the property. It outlines any known issues or defects, ensuring transparency between the seller and buyer regarding the property's state.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this disclosure informs buyers about potential lead hazards. It mandates that sellers disclose any known lead-based paint issues and allows buyers to conduct inspections.

- Home Inspection Report: A report generated by a professional home inspector, this document details the condition of various aspects of the property, including structural integrity, plumbing, and electrical systems. Buyers often rely on this report to identify necessary repairs before closing.

- Loan Estimate: Provided by the lender, this document outlines the estimated costs associated with obtaining a mortgage. It includes information on interest rates, monthly payments, and closing costs, helping buyers understand their financial obligations.

- Power of Attorney for a Child: This document enables a parent or guardian to designate someone else to make decisions for their child, ensuring that their needs are met when the parent is unavailable. For more information, visit georgiapdf.com/power-of-attorney-for-a-child.

- Appraisal Report: Conducted by a licensed appraiser, this report assesses the property's market value. Lenders typically require an appraisal to ensure that the loan amount does not exceed the property's worth.

- Closing Disclosure: This document is provided to the buyer and seller at least three days before closing. It outlines the final terms of the loan and details all closing costs, allowing both parties to review and understand their financial responsibilities prior to finalizing the transaction.

- Title Insurance Policy: This insurance protects the buyer and lender against potential disputes over property ownership. It ensures that the title is clear of any encumbrances or claims that could affect ownership rights.

These accompanying documents play a vital role in ensuring a smooth transaction process and protecting the interests of both buyers and sellers. Understanding each document's purpose can significantly enhance the experience of navigating real estate transactions in South Carolina.

Key takeaways

Understand the Parties Involved: Clearly identify the Buyer(s) and Seller(s) in the contract. This ensures that all parties are aware of their roles and responsibilities.

Property Description: Provide a detailed description of the property, including its address, tax map number, and any relevant details about the water and sewer systems.

Marketable Title: The Seller must convey a marketable title. This means the property should be free of significant legal encumbrances, ensuring the Buyer can obtain financing without issues.

Possession Timing: The Buyer typically receives possession at closing. Ensure the property is clean and free of debris at that time.

Earnest Money: An earnest money deposit is required. This shows the Buyer’s commitment to the purchase and will be credited toward the purchase price at closing.

Loan Contingency: The Buyer’s obligation to proceed is often contingent on securing financing. Timely application and approval are critical.

Closing Costs: Clearly outline who is responsible for which closing costs. This includes preparation of the deed, title examination, and other fees.

Condition of the Property: The Seller must disclose any known issues with the property. Buyers should conduct their inspections to ensure they are aware of the property's condition.

Expiration of Offer: Be aware that the Buyer’s offer has an expiration time. If not accepted by the Seller within that timeframe, the offer is withdrawn.

Create Other PDFs

South Carolina Sales Tax Return - Being diligent about deadlines helps avoid fines associated with late submissions.

For individuals looking to understand their legal options, a crucial resource is the Missouri Durable Power of Attorney documentation. This form allows you to appoint someone to navigate financial or medical decisions when necessary, ensuring your preferences are honored. To explore more about this process, you can refer to our comprehensive guide on the Durable Power of Attorney form.

South Carolina State Tax Form - Have your previous year's tax documents handy when completing your estimated tax worksheet.