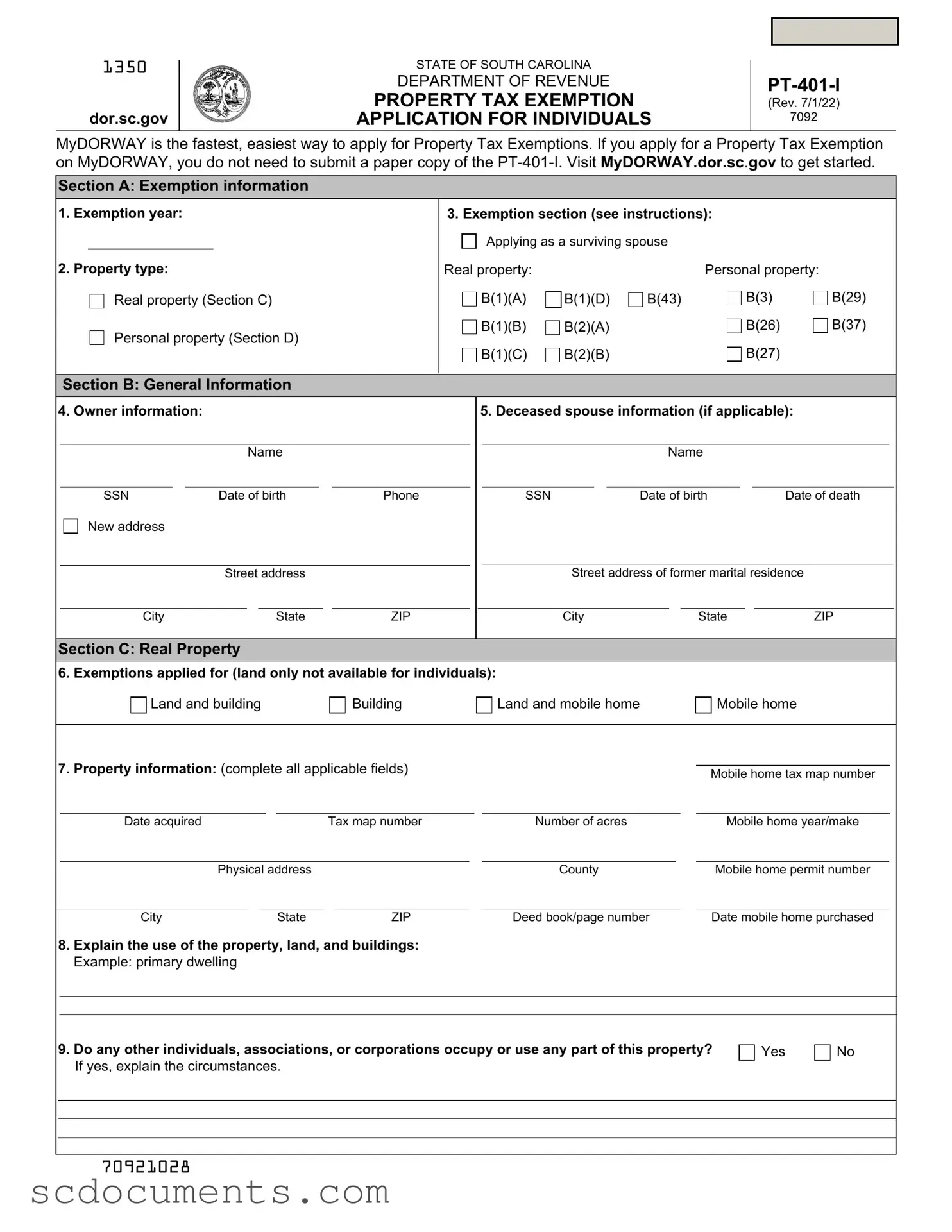

Blank South Carolina Pt 401 Template

Dos and Don'ts

When filling out the South Carolina PT-401 form, it is essential to follow specific guidelines to ensure a smooth application process. Here’s a list of things you should and shouldn't do:

- Do provide all requested information accurately. Missing details can lead to delays.

- Do print clearly in the application to avoid any misinterpretations.

- Do include all necessary supporting documents as specified in the instructions.

- Do double-check the application for completeness before submission.

- Do mail the application to the correct address to ensure it reaches the right department.

- Don't leave any sections blank. Incomplete applications will be returned.

- Don't use abbreviations or shorthand that may confuse the reviewers.

- Don't forget to sign and date the application; an unsigned form may be rejected.

- Don't submit the application without verifying that all documents are attached.

- Don't procrastinate; submit the application as early as possible to avoid last-minute issues.

File Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The PT-401 form is used to apply for property tax exemptions in South Carolina. |

| Governing Laws | The exemptions are governed by South Carolina Code Section 12-37-220. |

| Submission Requirement | The form must be completed by the property owner or an authorized agent. |

| Mailing Address | Applications should be mailed to the South Carolina Department of Revenue, Property Division, Columbia, SC 29214-0303. |

| Information Completeness | All sections of the form must be completed to avoid delays in processing. |

| Vehicle Identification | Applicants must provide the Vehicle Identification Number (VIN), not the license tag number. |

| Supporting Documents | Various documents, such as deeds and IRS letters, must accompany the application based on the exemption type. |

| Exemption Categories | Exemptions include properties for schools, charities, and certain veterans. |

| Deadline | Applications must be submitted by the deadline set by the South Carolina Department of Revenue each year. |

| Contact Information | For questions, applicants can contact the South Carolina Department of Revenue directly. |

Documents used along the form

The South Carolina PT-401 form is essential for applying for property tax exemptions. When submitting this form, several additional documents may be required to support the application. Below is a list of commonly used forms and documents that accompany the PT-401.

- Deed or Title to Real Property: This document proves ownership of the property for which the exemption is being requested. It should clearly indicate the legal owner and the property details.

- Vehicle Registration Card: This card is necessary for vehicles being claimed for exemption. It provides proof of ownership and registration details.

- Bill of Sale: This document serves as proof of purchase for any vehicles or property being claimed for exemption. It should include the purchase date and transaction details.

- IRS Determination Letter: This letter verifies the tax-exempt status of an organization under the Internal Revenue Code. It is crucial for nonprofit entities applying for property tax exemptions.

- Articles of Incorporation: This document outlines the formation of a corporation and its purpose. It is often required for nonprofit organizations seeking tax exemptions.

- Bylaws: Bylaws detail the operational rules of an organization. They may be requested to confirm the nonprofit status and governance structure.

- Power of Attorney: This document allows you to designate someone to make decisions on your behalf, which can be particularly important in managing your affairs. For more information, visit https://georgiapdf.com/power-of-attorney/.

- Audited Financial Statements: Recent financial statements, including balance sheets and income statements, are required to demonstrate the financial health of an organization applying for exemption.

- Lease Agreement: If the property is leased, this document outlines the terms of the lease and confirms the nonprofit use of the property.

- Physician's Statement: For individuals applying based on disability, a statement from a physician is necessary to confirm the medical condition and its impact on the applicant's ability to work.

Each of these documents plays a critical role in the application process for property tax exemptions in South Carolina. Ensure that all required documents are completed accurately to avoid delays in processing your application.

Key takeaways

Complete all sections of the South Carolina PT-401 form to avoid delays. Incomplete applications will be returned.

Provide accurate legal owner information, including address and identification numbers. This includes Social Security or Federal Identification Numbers.

Attach necessary documentation to support your exemption claim. This may include deeds, titles, and financial statements relevant to the property or organization.

Mail the completed application to the South Carolina Department of Revenue at the specified address to ensure proper processing.

Create Other PDFs

Online Cna Classes South Carolina - Highlight any applicable training hours completed in the relevant programs.

Additionally, it's important to ensure that all necessary forms are completed accurately to avoid any legal issues down the line. For those seeking comprehensive documentation, you can find what you need through resources like All Missouri Forms, which provide access to various essential legal templates including the Affidavit of Gift form.

South Carolina State Tax Form - Payment must be made in equal amounts over the specified quarterly due dates unless paid in full at once.