Blank South Carolina Abl Template

Dos and Don'ts

Things to Do When Filling Out the South Carolina ABL Form:

- Ensure your entity is registered with the South Carolina Secretary of State for at least 30 days if you are a corporation, LLC, or partnership.

- Provide a completed application that is signed and dated.

- Submit all required documents, including the ABL-946 for each principal.

- Include a criminal record check for all principals, dated within the last 90 days.

- Attach a copy of the Basic Permit issued by the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Things Not to Do When Filling Out the South Carolina ABL Form:

- Do not submit a PO Box as your physical location of business.

- Avoid leaving any required fields blank in the application.

- Do not forget to pay the permit fee, which is $400 biennially.

- Never provide outdated or incorrect criminal record checks.

- Do not ignore the requirement to designate a compliance agent for notifications.

File Attributes

| Fact Name | Description |

|---|---|

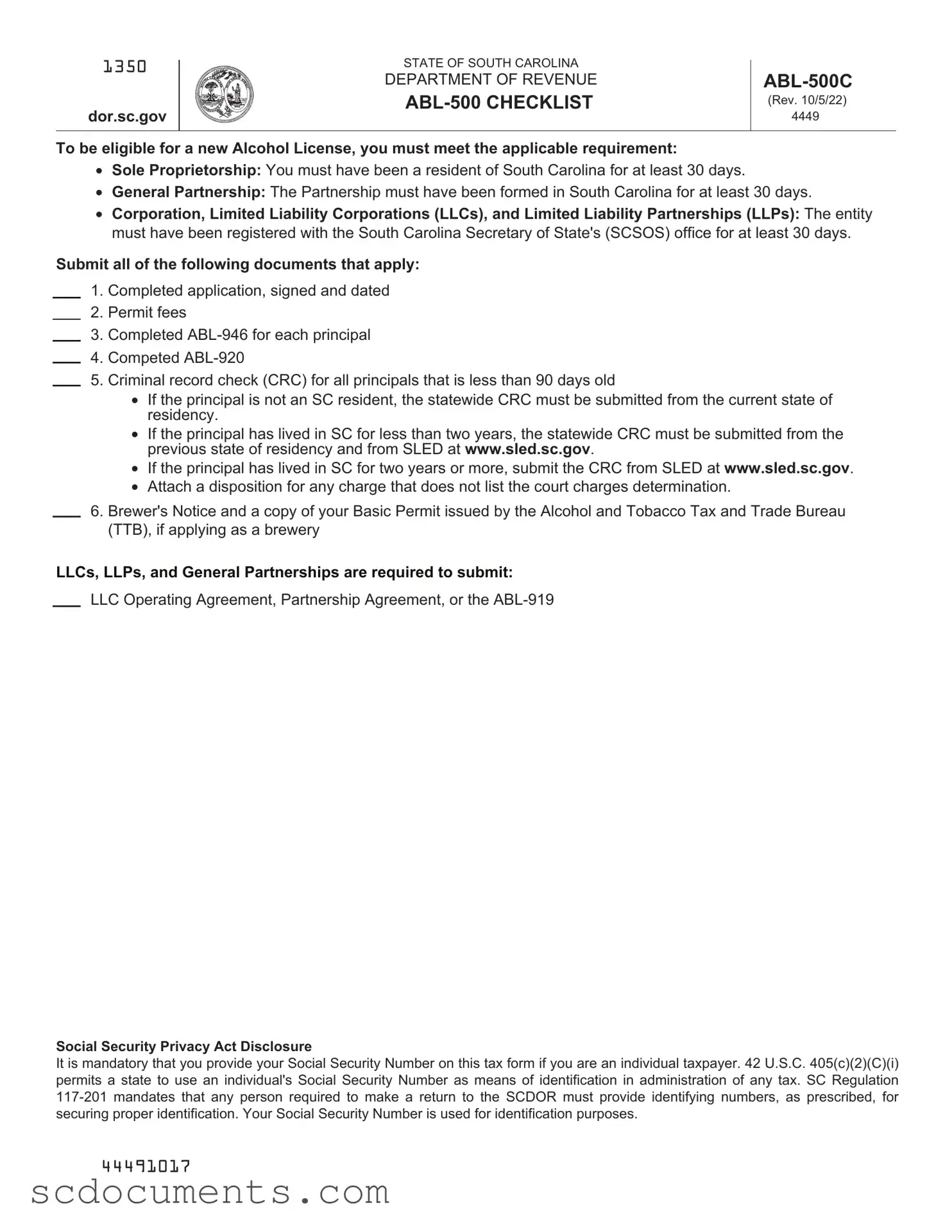

| Eligibility Requirements | Entities must be registered with the South Carolina Secretary of State for at least 30 days prior to applying. Sole proprietors must be residents for the same duration. |

| Application Components | The application requires several documents, including a completed application, permit fees, and criminal record checks for all principals. |

| Permit Fee | The fee for the ABL-500 application is $400 and is due biennially, expiring on August 31 of even-numbered years. |

| Processing Time | Application processing typically takes six to eight weeks. Delays may occur if the application is denied. |

| Governing Laws | The application and issuance of permits are governed by SC Code of Laws Title 61, Chapters 2, 4, and 6; Title 12 Chapters 21 and 33; and Title 20 Chapter 7. |

| Social Security Requirement | Providing a Social Security Number is mandatory for individual taxpayers. This requirement is supported by federal and state regulations. |

Documents used along the form

The South Carolina ABL form is a crucial document for those seeking to obtain a license for alcohol production or distribution. Along with this form, several other documents are often required to ensure compliance with state regulations. Below is a list of commonly used forms and documents that accompany the ABL form, each serving a specific purpose in the application process.

- ABL-946: This form is used for applicant and principal consent and waiver. Each principal of the entity must complete it, allowing the South Carolina Department of Revenue (SCDOR) to share tax information necessary for processing the application.

- ABL-920: Sole proprietors must complete this form when applying for a license. It captures essential details about the sole proprietor and their business operations.

- Missouri Affidavit of Gift form: This form serves to formally transfer personal property as a gift, ensuring clarity in gift-giving processes. For more information, All Missouri Forms are available.

- ABL-569: This application is for beer and wine brand registration. It requires information about the labels and brands intended for shipment, along with necessary approvals from the Alcohol and Tobacco Tax and Trade Bureau (TTB).

- Criminal Record Check (CRC): A CRC is required for all principals and must be less than 90 days old. Depending on residency duration, it may need to be sourced from the South Carolina Law Enforcement Division (SLED) or previous states of residence.

- LLC Operating Agreement or Partnership Agreement: This document outlines the operational structure and management of the business entity, ensuring that it complies with state regulations.

- Brewer's Notice: If applying as a brewery, this notice is necessary to confirm compliance with federal regulations and to establish the business as a legitimate brewing operation.

- Basic Permit from TTB: A copy of this permit is required for all alcohol producers and importers, confirming that the business is authorized to operate under federal law.

Completing the application process accurately and providing all required documents is essential for obtaining the necessary licenses. Each document plays a vital role in demonstrating compliance with both state and federal regulations, ultimately facilitating a smoother application experience.

Key takeaways

When filling out and using the South Carolina ABL form, there are several important points to keep in mind. Understanding these can help ensure a smoother application process.

- Eligibility Requirements: Your business entity must be registered with the South Carolina Secretary of State for at least 30 days before applying. Sole proprietors must also be residents of South Carolina for 30 days prior to application.

- Required Documentation: A completed application, permit fees, and various forms must be submitted. This includes ABL-946 for each principal and ABL-920 for sole proprietors.

- Criminal Record Checks: All principals must provide a criminal record check that is less than 90 days old. The requirements vary based on how long the principal has resided in South Carolina.

- Designated Agent: You must designate a person to receive all notices regarding your license or permit. Keeping the SCDOR informed of any changes is essential.

- Processing Time: Be prepared for a processing time of at least six to eight weeks. Delays may occur if your application is denied.

- Tax Compliance: The SCDOR will not issue a license to anyone with outstanding tax obligations. Ensure all taxes are current before applying.

By following these guidelines, you can help facilitate the application process and meet the necessary requirements for obtaining your alcohol beverage license in South Carolina.

Create Other PDFs

South Carolina Sales Tax Return - Each section on the form corresponds to specific tax reporting requirements.

Online Cna Classes South Carolina - Applications must be complete; incomplete submissions will not be processed.

For those interested in safeguarding their financial decisions, the Missouri Durable Power of Attorney documentation can provide essential clarity and protection, ensuring that your chosen representative can act effectively in times of need.

South Carolina Fishing License Online - The application requires both contact information and residence specifics for verification purposes.