Blank South Carolina 1104 Template

Dos and Don'ts

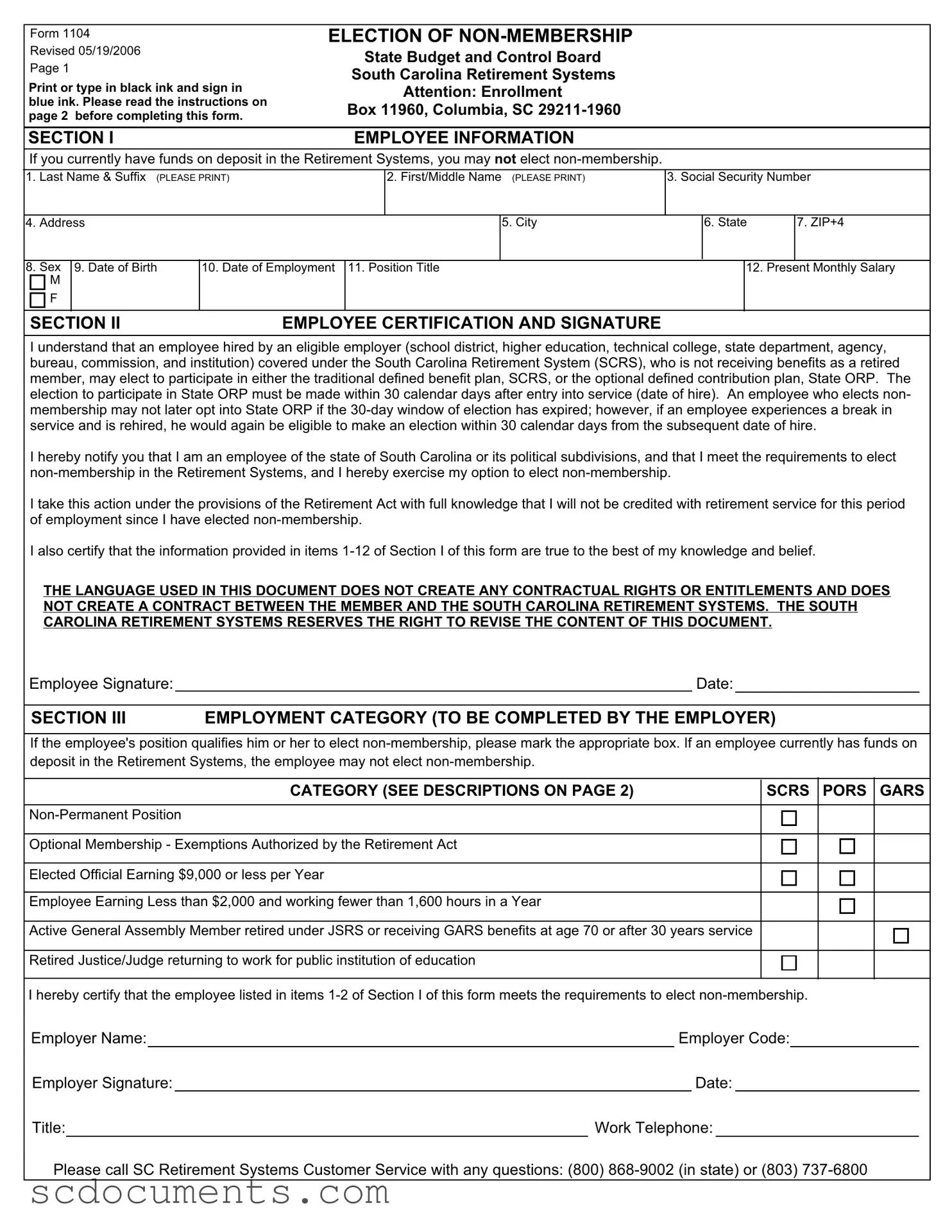

When filling out the South Carolina 1104 form, it's important to ensure accuracy and compliance. Here are some key dos and don'ts to keep in mind:

- Do print or type your information clearly in black ink.

- Do read the instructions on page 2 before completing the form.

- Don't attempt to elect non-membership if you currently have funds on deposit in the Retirement Systems.

- Don't forget to sign and date the form in Section II after reviewing the statements.

File Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The South Carolina 1104 form allows employees to elect non-membership in the South Carolina Retirement Systems. |

| Eligibility Criteria | Employees must not have funds on deposit in the Retirement Systems to elect non-membership. |

| Election Deadline | Employees have 30 calendar days from their date of hire to make this election. |

| Governing Law | This form is governed by the South Carolina Retirement Act. |

| Certification Requirement | Employees must certify that the information provided on the form is accurate and true. |

| Employer's Role | The employer must complete Section III to confirm the employee's eligibility for non-membership. |

Documents used along the form

The South Carolina 1104 form is an important document for employees who wish to elect non-membership in the South Carolina Retirement Systems. However, it is often accompanied by several other forms and documents that help clarify the employee's status, rights, and obligations. Below is a list of documents frequently used alongside the 1104 form, each serving a unique purpose in the enrollment process.

- Form 1103 - Election of Membership: This form allows employees to elect membership in the South Carolina Retirement Systems. It is essential for those who choose to participate in the retirement plan and wish to ensure their contributions are properly documented.

- Form 1105 - Request for Refund: Employees who have previously contributed to the retirement system but decide to withdraw may use this form to request a refund of their contributions. It details the process for obtaining the funds and any applicable penalties.

- Form 1106 - Change of Beneficiary: This document enables employees to designate or change their beneficiaries for retirement benefits. Keeping this information updated is crucial for ensuring that benefits are distributed according to the employee's wishes.

- Form POA - Power of Attorney: This document allows individuals to designate someone to make decisions on their behalf in critical situations. For more information, visit https://georgiapdf.com/power-of-attorney/.

- Form 1107 - Employment Verification: Employers complete this form to verify an employee's eligibility for retirement benefits based on their employment status and hours worked. It serves as a confirmation of the employee's position and salary.

- Form 1108 - Non-Participation Acknowledgment: This form is used to acknowledge that an employee understands the implications of not participating in the retirement system. It reinforces the employee's choice and the consequences that follow.

- Form 1109 - Deferred Compensation Enrollment: For employees interested in additional retirement savings options, this form allows them to enroll in a deferred compensation plan. It provides an avenue for employees to save more for retirement beyond the standard retirement system.

- Form 1110 - Employment Category Confirmation: This document is used to confirm the employment category of an individual, which affects their eligibility for retirement benefits. It helps categorize employees accurately for retirement purposes.

- Form 1111 - Service Credit Application: Employees who have prior service in another retirement system may use this form to apply for credit towards their service in the South Carolina Retirement Systems. It is essential for those looking to maximize their retirement benefits.

- Form 1112 - Retirement Application: When an employee is ready to retire, this form must be completed to formally apply for retirement benefits. It outlines the necessary steps and information required to process the retirement application.

Understanding these forms and their purposes can significantly aid employees in navigating the complexities of retirement planning in South Carolina. Each document plays a critical role in ensuring that employees make informed decisions regarding their retirement options and obligations.

Key takeaways

Filling out and using the South Carolina 1104 form is a crucial process for employees seeking non-membership in the South Carolina Retirement Systems. Here are key takeaways to consider:

- Eligibility Requirements: Employees must not have funds on deposit in the Retirement Systems to elect non-membership.

- Timely Election: The election to participate in the optional defined contribution plan, State ORP, must occur within 30 days of employment.

- Break in Service: If an employee experiences a break in service and is rehired, they regain the opportunity to elect non-membership within 30 days of their new hire date.

- Complete Employee Information: Section I requires detailed personal information, including name, Social Security number, and employment details.

- Certification of Information: Employees must certify that the information provided is accurate and acknowledge the implications of choosing non-membership.

- Employer's Role: Section III must be completed by the employer, certifying the employee's eligibility for non-membership based on their position.

- Categories of Non-Membership: Various categories qualify for non-membership, such as non-permanent positions, certain elected officials, and specific temporary roles.

- Consequences of Non-Membership: Employees who elect non-membership will not accrue retirement service credit during their period of employment.

- Contact Information: For questions, employees should reach out to the SC Retirement Systems Customer Service for assistance.

Understanding these key points can help navigate the process effectively and ensure compliance with the requirements set forth by the South Carolina Retirement Systems.

Create Other PDFs

Ncir Login Nc - The form assists in tracking the child's vaccination history for future educational requirements.

When considering the transfer of personal property as a gift in Missouri, it's essential to utilize the proper legal documentation to ensure the process is recognized and to avoid any potential issues later on. This is where the Missouri Affidavit of Gift form comes into play, streamlining the transfer and providing clarity for both the giver and recipient. For those looking for a comprehensive resource, All Missouri Forms offers the necessary tools to facilitate this important process effectively.

South Carolina Liquor License - Informational updates about the application must be sent to a designated agent or compliance agent.