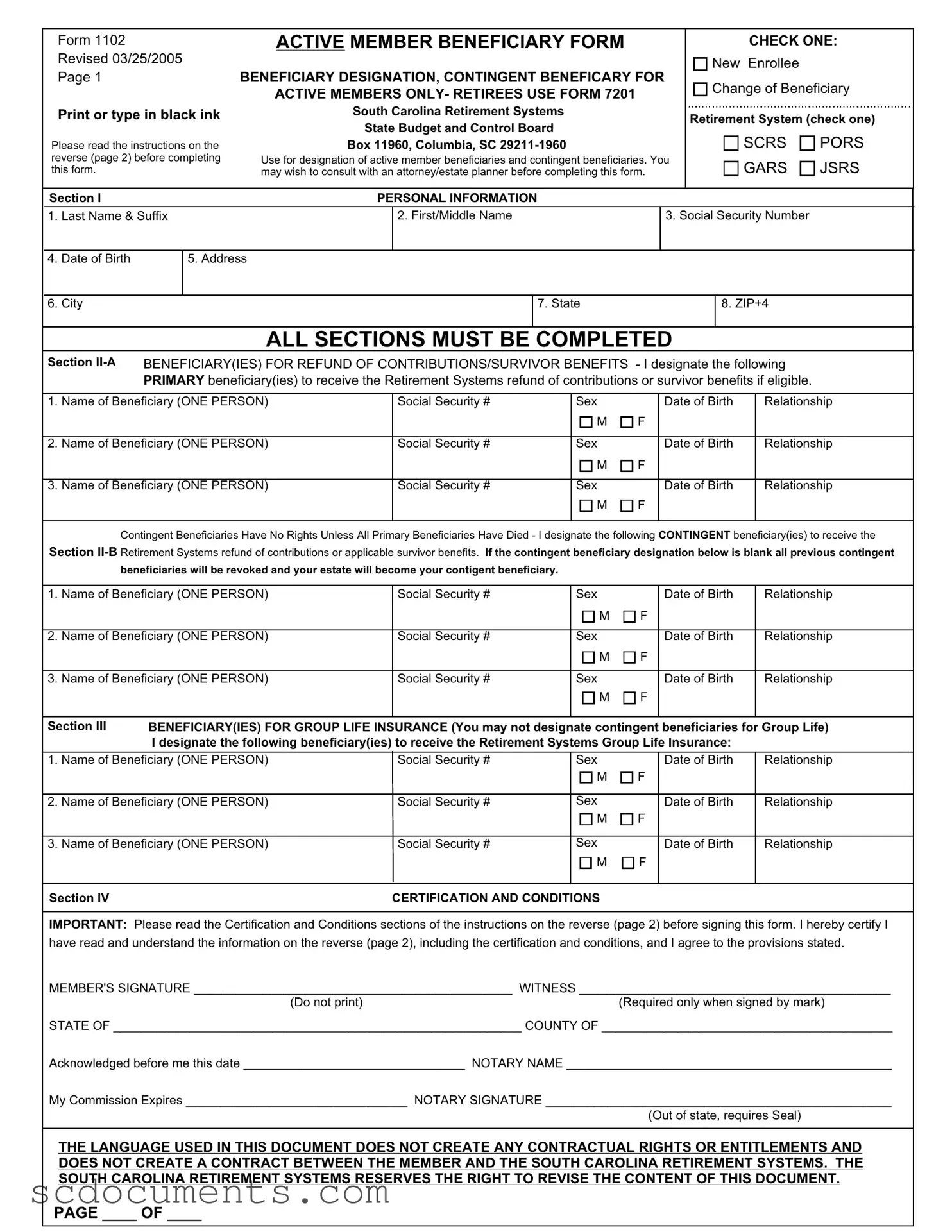

Blank South Carolina 1102 Template

Dos and Don'ts

When filling out the South Carolina 1102 form, it’s essential to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that your form is completed correctly.

- Do read the instructions on the reverse side of the form carefully before starting.

- Do fill out all sections completely. Incomplete forms may delay processing.

- Do use black ink and print or type your information clearly.

- Do designate both primary and contingent beneficiaries, if applicable.

- Do ensure that your form is notarized correctly before submitting.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't alter the form in any way; changes can lead to rejection.

By following these guidelines, you can help ensure that your beneficiary designations are processed smoothly and accurately. Taking the time to complete the form correctly is a crucial step in securing your retirement benefits for your loved ones.

File Attributes

| Fact Name | Details |

|---|---|

| Form Purpose | The South Carolina 1102 form is used for designating beneficiaries for active members of the retirement system. |

| Applicable Systems | This form applies to members of the South Carolina Retirement System, including SCRS, PORS, GARS, and JSRS. |

| Governing Laws | The form is governed by South Carolina Code of Laws §9-1-1650, §9-9-100, and §9-11-110. |

| Completion Requirements | All sections of the form must be completed in full. Incomplete forms will not be accepted. |

| Notarization | The member must sign the form in the presence of a notary public for it to be valid. |

Documents used along the form

The South Carolina 1102 form is a crucial document for active members of the South Carolina Retirement Systems. It allows members to designate beneficiaries for retirement contributions and survivor benefits. In addition to this form, several other documents are often used in conjunction with it to ensure proper handling of retirement benefits and related matters. Below is a list of these forms and documents, along with a brief description of each.

- Form 7201: This form is specifically for retirees to designate beneficiaries. It serves a similar purpose as the 1102 form but is tailored for those who have already retired.

- Form 1102A: Used for designating additional primary and contingent beneficiaries. This form allows members to provide more than the three beneficiaries listed on the 1102 form.

- Form 1102B: This document is for members who wish to revoke previous beneficiary designations. It ensures that outdated designations do not remain in effect.

- Form 1102C: A change of address form that updates the member's personal information within the retirement system, ensuring that all communications are sent to the correct location.

- Durable Power of Attorney Form: For those needing to empower another to make decisions on their behalf, consider the comprehensive Durable Power of Attorney template for ensuring your wishes are respected during critical times.

- Form 1102D: This form is used to apply for a refund of contributions. It allows members to withdraw their contributions if they leave employment before retirement.

- Group Life Insurance Application: This document is necessary for members who wish to enroll in or change their group life insurance coverage. It details the coverage options available.

- Power of Attorney: This legal document allows a member to appoint someone else to make decisions on their behalf regarding their retirement benefits, especially if they become incapacitated.

- Beneficiary Change Notification: This form is used to notify the retirement system of any changes to beneficiary designations outside the regular forms, ensuring that updates are recorded promptly.

- Notarization Acknowledgment: A separate document that may be required for notarizing signatures on forms, ensuring that all signatures are valid and legally binding.

Understanding these additional forms and documents is essential for active members and retirees alike. They help ensure that beneficiaries are correctly designated and that retirement benefits are managed according to the member's wishes. Proper completion and submission of these forms can prevent complications in the future, making it vital for members to stay informed about their options.

Key takeaways

Filling out the South Carolina 1102 form is a crucial step for active members of the retirement system to designate beneficiaries. Here are key takeaways to keep in mind:

- Complete All Sections: Ensure that every section of the form is filled out completely. Incomplete forms may lead to processing delays.

- Beneficiary Designation: You can designate primary beneficiaries for the refund of contributions or survivor benefits. Only one person can be named per line.

- Contingent Beneficiaries: Contingent beneficiaries will only receive benefits if all primary beneficiaries have passed away. If this section is left blank, your estate will default as the beneficiary.

- Group Life Insurance: Different beneficiaries can be designated for group life insurance, but no contingent beneficiaries can be named for this section.

- Notarization Required: The form must be signed in the presence of a notary public. All forms must be notarized on the same date if multiple forms are completed.

- Revocation of Previous Designations: Signing this form revokes all previous beneficiary designations. It is essential to understand this before submitting the form.

- Consultation Recommended: It may be beneficial to consult with an attorney or estate planner before completing the form to ensure your wishes are accurately reflected.

- Multiple Systems: If you are a member of more than one retirement system, a separate 1102 form must be completed for each system.

- Payment Discharge: The South Carolina Retirement Systems will be fully discharged of liability for any payments made to the designated beneficiaries.

- Contact Information: For questions or assistance, you can contact the South Carolina Retirement Systems Customer Service.

Understanding these points can help ensure that the beneficiary designations align with your intentions and are processed smoothly.

Create Other PDFs

South Carolina Liquor License - A criminal record check must be provided for all principals, no older than 90 days.

The process of gifting property in Missouri can be simplified with the Missouri Affidavit of Gift form, which serves as a clear declaration that the items are given without the expectation of compensation. This legal acknowledgment not only solidifies the intention behind the gift but also helps to navigate any potential tax implications. For anyone looking to ensure their gift is properly documented, All Missouri Forms provides the necessary resources to assist you in completing this important documentation.

Sc Homestead Exemption - Copies of property deeds and organization documents must be submitted with the application.

Irs Form 8453 - Employees must read all instructions thoroughly before completing Form 1104.