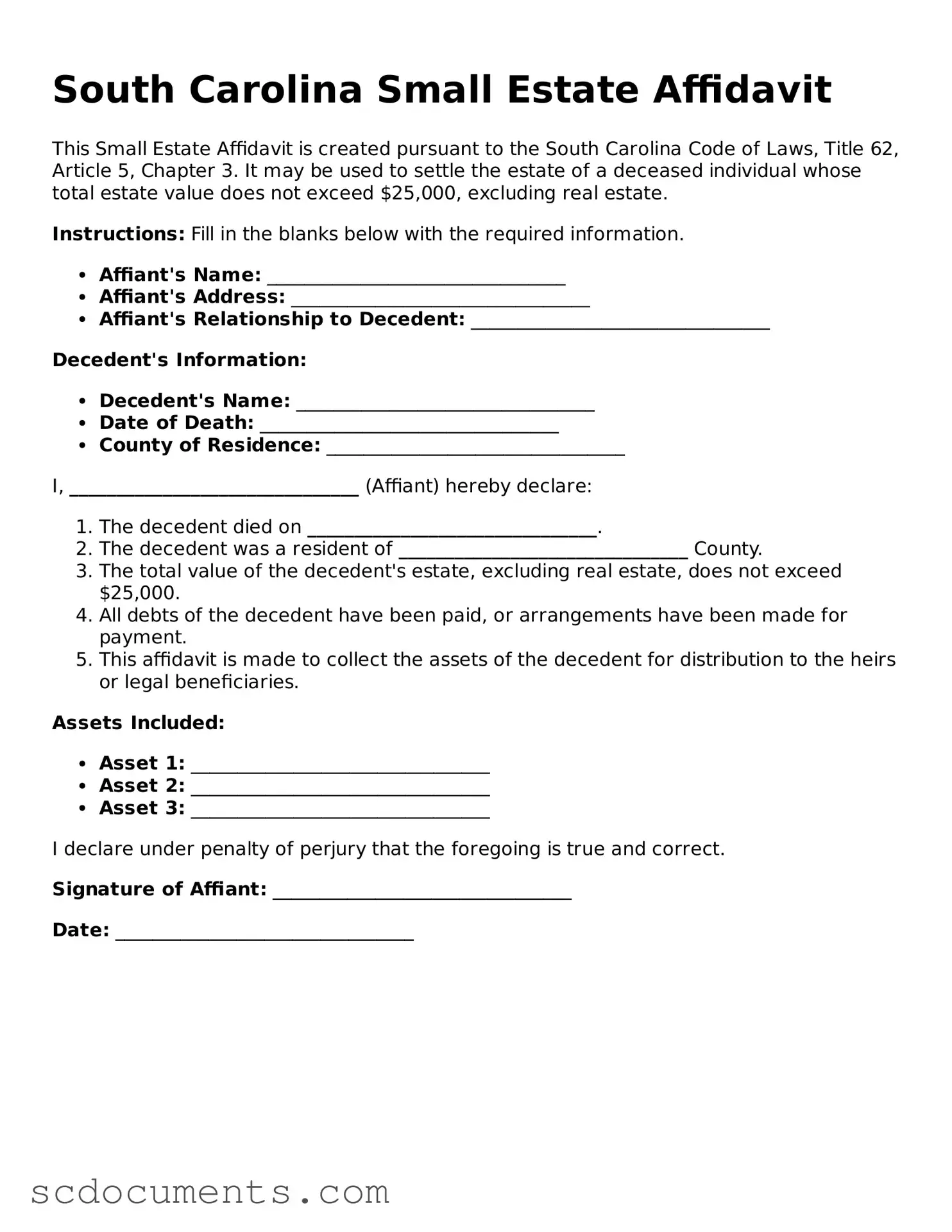

Legal South Carolina Small Estate Affidavit Form

Dos and Don'ts

When filling out the South Carolina Small Estate Affidavit form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some things to do and avoid:

- Do: Provide accurate information about the deceased, including their full name and date of death.

- Do: List all assets that fall under the small estate limit as defined by South Carolina law.

- Do: Sign the affidavit in front of a notary public to validate the document.

- Do: Ensure that you are eligible to file the affidavit, typically as an heir or a personal representative.

- Don't: Leave any sections of the form blank; all required fields must be completed.

- Don't: Include assets that exceed the small estate limit, as this could invalidate the affidavit.

- Don't: Forget to check for any local requirements or additional documentation that may be needed.

- Don't: Rush through the process; take your time to review the information for accuracy.

File Data

| Fact Name | Details |

|---|---|

| Purpose | The South Carolina Small Estate Affidavit allows heirs to claim property without formal probate for small estates. |

| Eligibility | Estates valued at $25,000 or less for individuals and $50,000 or less for married couples qualify for this affidavit. |

| Governing Law | This affidavit is governed by South Carolina Code § 62-3-1201. |

| Required Information | Affidavits must include the decedent's name, date of death, and a list of assets. |

| Filing Process | The affidavit should be filed with the local probate court to initiate the transfer of assets. |

| Witness Requirement | At least two witnesses must sign the affidavit to verify the information provided. |

| Use of Form | This form is typically used by heirs to access bank accounts, real estate, and personal property. |

| Limitations | The Small Estate Affidavit cannot be used for estates that include real property valued over the specified limits. |

| Timeframe | Heirs can use the affidavit immediately after the decedent's death, provided all conditions are met. |

Documents used along the form

When dealing with the South Carolina Small Estate Affidavit, several other forms and documents may be necessary to ensure a smooth process. These documents help clarify the estate's details and facilitate the distribution of assets. Here is a list of commonly used forms alongside the Small Estate Affidavit.

- Death Certificate: This official document confirms the death of the individual whose estate is being settled. It is crucial for proving the decedent's passing and is often required for legal proceedings.

- Power of Attorney: This document allows an individual to appoint someone to make decisions on their behalf, which can be essential in managing affairs during challenging times. For more information, visit georgiapdf.com/power-of-attorney/.

- Will: If the decedent left a will, this document outlines their wishes regarding asset distribution. It may be necessary to present the will even if the estate qualifies for the Small Estate Affidavit.

- Inventory of Assets: This form lists all the assets owned by the decedent at the time of death. It helps establish the total value of the estate and is useful for both heirs and creditors.

- Affidavit of Heirship: In some cases, this document may be required to establish the identity of the heirs. It provides a sworn statement about the relationship between the decedent and the heirs.

- Notice to Creditors: This form informs creditors of the decedent's passing and provides them an opportunity to make claims against the estate. It's an important step in settling any outstanding debts.

- Tax Returns: Copies of the decedent's final income tax returns may be needed to ensure all tax obligations are met. This helps avoid any potential issues with the IRS.

- Bank Statements: Recent bank statements for the decedent's accounts can help in verifying the estate's assets and ensuring that all financial matters are in order.

- Property Deeds: If the decedent owned real estate, copies of property deeds will be necessary to transfer ownership to the heirs as outlined in the Small Estate Affidavit.

- Letters of Administration: If there is no will, this document may be needed to appoint an administrator to manage the estate. It helps establish legal authority over the estate's assets.

Having these documents prepared can greatly simplify the process of settling a small estate in South Carolina. Each form plays a vital role in ensuring that all legal requirements are met and that the wishes of the decedent are honored. It's always a good idea to consult with a professional if there are any questions or uncertainties about the process.

Key takeaways

When dealing with the South Carolina Small Estate Affidavit form, it’s important to understand the key aspects that will guide you through the process. Here are some essential takeaways:

- The Small Estate Affidavit is used to simplify the process of settling an estate when the total value of the estate is under $25,000.

- Only certain assets qualify for this affidavit, including bank accounts, personal property, and vehicles.

- To use the affidavit, you must be an eligible heir or a person entitled to the estate under South Carolina law.

- The affidavit must be signed in front of a notary public to be considered valid.

- Gather all necessary documentation, such as death certificates and asset valuations, before filling out the form.

- Complete the form accurately to avoid delays in the process; errors can lead to complications.

- Once the affidavit is filled out and notarized, it should be presented to institutions holding the deceased's assets.

- Heirs should be aware that they may be required to provide proof of their relationship to the deceased.

- Using the Small Estate Affidavit can expedite the distribution of assets, making it a convenient option for small estates.

- It’s advisable to consult with a legal professional if there are any uncertainties about the process or the form.

Other South Carolina Templates

56/19 - This form can help to establish the sale price, which may be necessary for tax assessment purposes.

Sc Homeschool Laws - A way to communicate educational intentions to local officials.

The process of transferring personal property as a gift in Missouri can be made simpler through the completion of the Missouri Affidavit of Gift form, a crucial legal document that certifies the lack of monetary exchange and clarifies the giver's intent. For those looking to navigate this process seamlessly and ensure legal recognition of their gift, it's beneficial to consult resources that provide comprehensive information on this matter, such as All Missouri Forms.

Will in South Carolina - Crafting a Living Will allows you to share your thoughts on quality of life with loved ones.