Legal South Carolina Quitclaim Deed Form

Dos and Don'ts

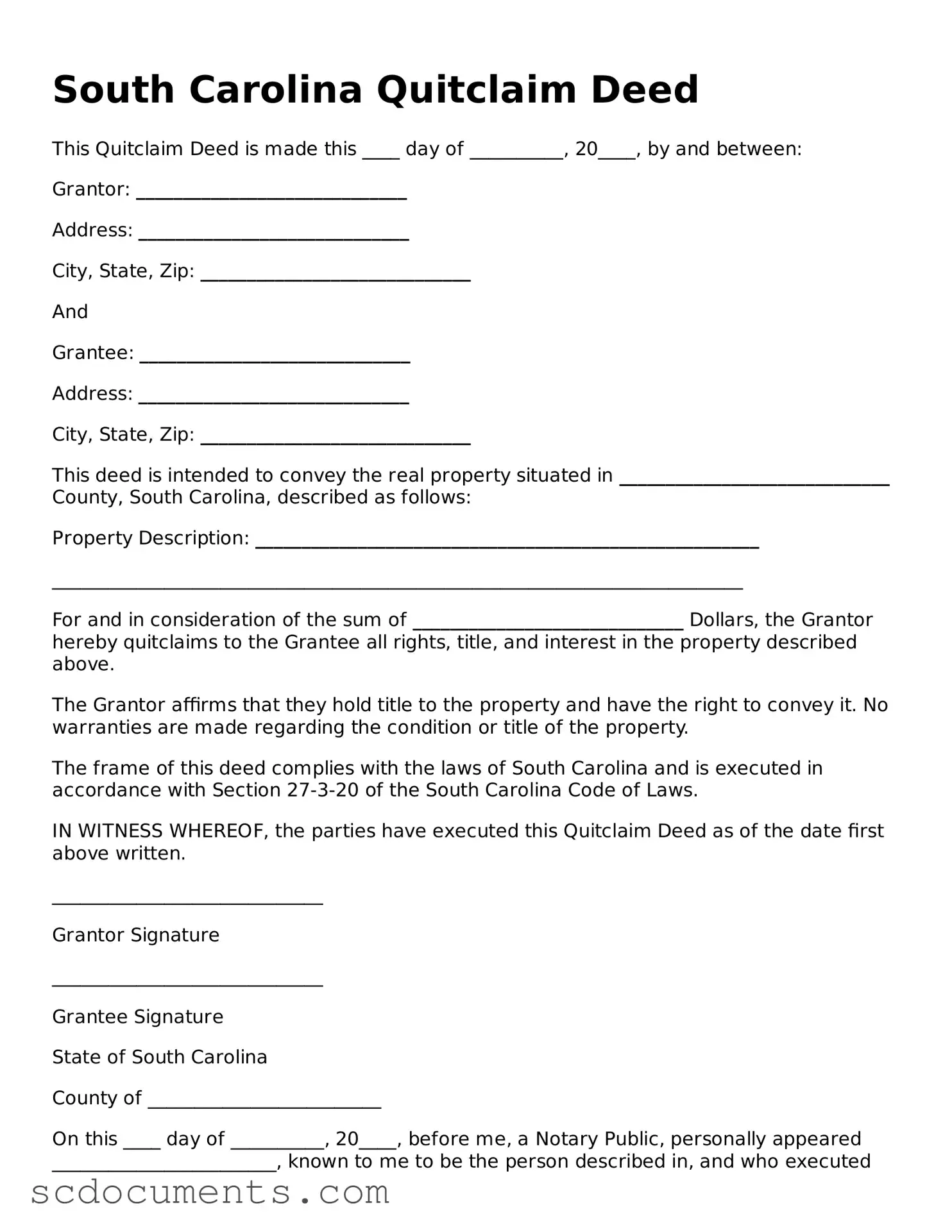

When filling out the South Carolina Quitclaim Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn’t do:

- Do ensure that all names are spelled correctly. Mistakes can lead to complications later on.

- Do include the legal description of the property. This information is crucial for identifying the property in question.

- Do sign the document in front of a notary public. A notary’s signature adds legitimacy to the deed.

- Don't leave any sections blank. Incomplete forms can cause delays or rejections.

- Don't forget to check local recording requirements. Each county may have specific rules regarding how deeds must be filed.

File Data

| Fact Name | Details |

|---|---|

| Definition | A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. |

| Purpose | It is commonly used to transfer property between family members or to clear up title issues. |

| Governing Law | The Quitclaim Deed in South Carolina is governed by Title 27, Chapter 7 of the South Carolina Code of Laws. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Notarization | A Quitclaim Deed must be notarized to be legally effective. |

| Recording | To provide public notice, the deed should be recorded at the county register of deeds. |

| Consideration | While consideration is often stated, it is not required for the deed to be valid. |

| Limitations | This type of deed does not guarantee that the grantor has the right to transfer the property. |

| Tax Implications | Transferring property via a Quitclaim Deed may have tax consequences; consult a tax professional. |

Documents used along the form

When dealing with property transfers in South Carolina, a Quitclaim Deed is a key document. However, several other forms and documents often accompany it to ensure a smooth transaction. Here’s a list of those documents, along with a brief description of each.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It provides more protection to the buyer compared to a quitclaim deed.

- Title Search Report: A title search report outlines the history of ownership for the property. It helps identify any liens or encumbrances that may affect the title.

- Property Transfer Tax Form: This form is required for reporting the transfer of property and ensuring that any applicable taxes are paid during the transaction.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner of the property and discloses any potential issues that could affect the title.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the sale price, closing costs, and any adjustments made during the closing process.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Missouri 5177 Form: This essential document is used for correcting or completing vehicle title information in Missouri, facilitating accurate ownership documentation. All Missouri Forms

- Power of Attorney: This legal document allows someone to act on behalf of another person in the transaction. It can be useful if the seller cannot be present at closing.

- Property Disclosure Statement: This form requires the seller to disclose any known issues with the property, such as structural problems or past repairs, to the buyer.

- Loan Documents: If the buyer is financing the purchase, various loan documents will be required, including the mortgage agreement and loan application.

Understanding these documents can help facilitate a successful property transfer in South Carolina. Each plays a unique role in protecting the interests of both buyers and sellers, ensuring that the transaction is legally sound and transparent.

Key takeaways

When filling out and using the South Carolina Quitclaim Deed form, it is essential to keep several key points in mind. Understanding these can help ensure a smooth transfer of property rights.

- Clear Identification: Ensure that both the grantor (the person transferring the property) and the grantee (the person receiving the property) are clearly identified. Include full names and addresses to avoid any confusion.

- Property Description: Provide a detailed description of the property being transferred. This includes the legal description, which can typically be found in the property’s existing deed or tax records.

- Signatures Required: The Quitclaim Deed must be signed by the grantor. In South Carolina, it is advisable to have the signature notarized to enhance the document’s legal validity.

- Filing the Deed: After completing the form, it must be filed with the county Register of Deeds office where the property is located. This step is crucial for the deed to be legally recognized.

By following these guidelines, individuals can navigate the process of using a Quitclaim Deed in South Carolina more effectively.

Other South Carolina Templates

Sc Title - This document often requires the date of sale to establish when the ownership was transferred.

When you are ready to proceed with the necessary legal arrangements, you can access the georgiapdf.com/power-of-attorney for guidance on securing your Power of Attorney, ensuring that you have the right tools to protect your interests and facilitate decision-making in times of need.

South Carolina Vehicle Bill of Sale - A Bill of Sale is a straightforward solution to documenting a sale, regardless of item type.