Legal South Carolina Promissory Note Form

Dos and Don'ts

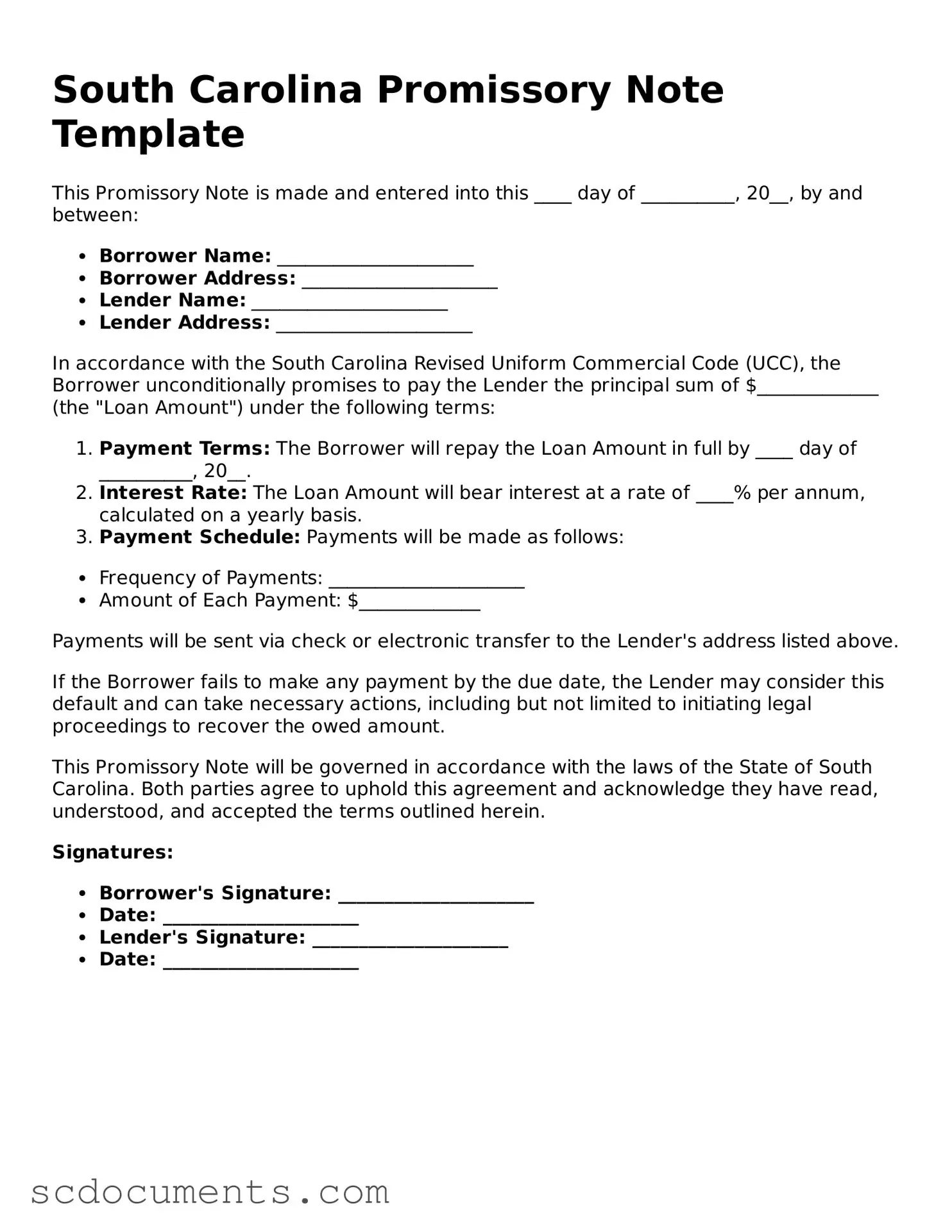

When filling out the South Carolina Promissory Note form, it’s essential to ensure accuracy and clarity. Here are nine important dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do include all required information, such as names, addresses, and loan amounts.

- Do specify the interest rate clearly, if applicable.

- Do indicate the repayment schedule, including due dates.

- Do sign and date the document in the appropriate places.

- Don't leave any blank spaces; fill in all sections completely.

- Don't use unclear language or abbreviations that might confuse the reader.

- Don't forget to keep a copy for your records after signing.

- Don't rush through the process; take your time to ensure everything is correct.

File Data

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a certain time. |

| Governing Law | In South Carolina, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3. |

| Essential Elements | A valid promissory note must include the amount to be paid, the interest rate (if any), the payment due date, and the signatures of the parties involved. |

| Enforceability | Promissory notes are legally binding contracts. If the borrower fails to repay, the lender can take legal action to recover the owed amount. |

| Types | There are various types of promissory notes, including secured and unsecured notes, which differ based on whether collateral is involved. |

Documents used along the form

When dealing with a South Carolina Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose, complementing the promissory note and providing additional context or security for the transaction.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive agreement between the borrower and lender.

- Security Agreement: If the loan is secured by collateral, this document details the specific assets that back the loan. It establishes the lender's rights to the collateral in case of default.

- Payment Schedule: A separate document that breaks down the repayment timeline, including due dates and amounts. This helps both parties keep track of payments and avoid confusion.

- Notice of Default: Should the borrower fail to meet the repayment terms, this document formally notifies them of their default status. It serves as a critical step before taking further legal action.

- Hold Harmless Agreement: To protect yourself from potential liabilities, consider using our comprehensive Hold Harmless Agreement resources to understand the importance of this legal document.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations and confirms that the lender has no remaining claims against them.

- Personal Guarantee: In cases where the borrower is a business, this document may require an individual to personally guarantee the loan, making them liable if the business defaults.

- Amendment Agreement: If any terms of the original promissory note need to be changed, this document outlines the amendments and requires signatures from both parties.

- Disclosure Statement: This document provides important information about the loan, including fees and potential risks, ensuring that the borrower is fully informed before signing.

- Affidavit of Identity: Sometimes required to verify the identities of the parties involved, this document helps prevent fraud and confirms that all parties are who they claim to be.

- Witness Statement: In some cases, having a witness sign the promissory note can add an extra layer of validity. This document records the witness's acknowledgment of the agreement.

Utilizing these documents alongside the South Carolina Promissory Note can help ensure a smoother transaction and provide protection for both the borrower and the lender. Each document plays a vital role in creating a comprehensive framework for the loan agreement.

Key takeaways

When filling out and using the South Carolina Promissory Note form, keep these key takeaways in mind:

- Clearly state the amount borrowed. The principal amount must be specified in both numbers and words.

- Include the names and addresses of both the borrower and the lender. This ensures that all parties are easily identifiable.

- Define the interest rate. Specify whether it is fixed or variable and clearly outline how it will be calculated.

- Set a repayment schedule. Indicate the frequency of payments, such as monthly or quarterly, and the due dates.

- Outline any late fees. Clearly state the penalties for late payments to avoid misunderstandings.

- Include a default clause. This should explain what happens if the borrower fails to make payments.

- Specify the governing law. Indicate that South Carolina law applies to the agreement.

- Provide space for signatures. Both parties must sign and date the document to make it legally binding.

- Consider notarization. While not always required, having the document notarized can add an extra layer of legitimacy.

- Keep copies of the signed note. Both the borrower and lender should retain a copy for their records.

Other South Carolina Templates

Transfer on Death Deed South Carolina - A Transfer-on-Death Deed is useful for ensuring assets are passed seamlessly to heirs.

Is South Carolina Community Property State - Acts as a reference point for future interactions regarding financial matters.

To successfully navigate the process of correcting vehicle title information, individuals can benefit from understanding the importance of the Missouri 5177 form. This form serves as a vital tool in ensuring that all details related to vehicle ownership are accurate and up to date. For a comprehensive overview of the necessary documents and procedures, you can refer to All Missouri Forms, which provide valuable resources for managing your vehicle title corrections efficiently.

South Carolina Prenup Contract - This document can outline how to handle financial disputes if they arise.