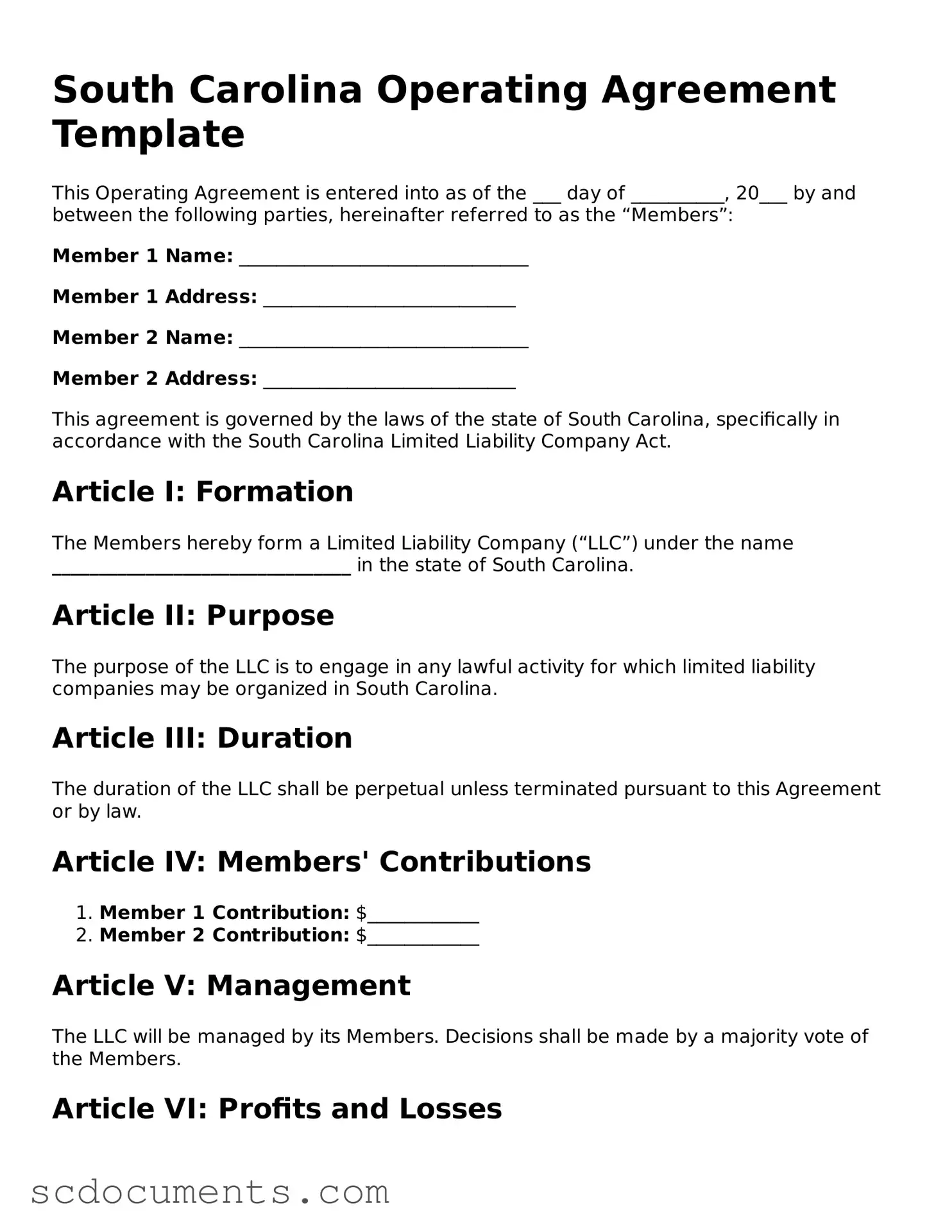

Legal South Carolina Operating Agreement Form

Dos and Don'ts

When filling out the South Carolina Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do consult with a legal professional if you have questions.

- Do keep a copy of the completed form for your records.

- Don't rush through the process; take your time.

- Don't leave any required fields blank.

By following these guidelines, you can help ensure that your Operating Agreement is properly filled out and submitted. This can save you time and potential issues in the future.

File Data

| Fact Name | Details |

|---|---|

| Purpose | The South Carolina Operating Agreement outlines the management structure and operating procedures for a Limited Liability Company (LLC). |

| Governing Law | The agreement is governed by South Carolina Code of Laws, Title 33, Chapter 44, which pertains to LLCs. |

| Members' Rights | It defines the rights and responsibilities of the members, including voting rights and profit distribution. |

| Flexibility | Members can customize the agreement to suit their specific needs, allowing for various management structures. |

| Not Mandatory | While recommended, the Operating Agreement is not required by law in South Carolina for LLCs. |

| Amendments | The agreement can be amended as needed, provided all members agree to the changes. |

Documents used along the form

When establishing a business in South Carolina, particularly a limited liability company (LLC), several forms and documents accompany the Operating Agreement. Each of these documents plays a crucial role in defining the structure and operations of the business. Below is a list of key forms often used alongside the South Carolina Operating Agreement.

- Articles of Organization: This document is filed with the South Carolina Secretary of State to officially create the LLC. It includes essential information such as the company name, address, and the registered agent.

- Member Consent Forms: These forms are used to document the agreement among members regarding significant decisions or actions that require consent, ensuring that all members are on the same page.

- Bylaws: While not mandatory for LLCs, bylaws can outline the internal governance of the company, detailing how decisions are made, how meetings are conducted, and the roles of members.

- Power of Attorney: It is essential for business owners to consider a Power of Attorney, especially when they are unable to make crucial decisions themselves; for more information, you can visit georgiapdf.com/power-of-attorney/.

- Operating Procedures: This document may outline specific operational guidelines for the LLC, including day-to-day management practices and protocols for handling various business scenarios.

- Membership Certificates: These certificates serve as proof of ownership in the LLC, indicating each member's share or interest in the company.

- Tax Forms: Depending on the structure and activities of the LLC, various tax forms may be required, including those for federal and state tax registration, ensuring compliance with tax obligations.

- Bank Resolution: This document is often needed to authorize specific individuals to open and manage the business bank account, ensuring that financial transactions are conducted by designated members.

Each of these documents contributes to the comprehensive framework needed for a successful LLC in South Carolina. Properly completing and maintaining these forms can help ensure clarity, compliance, and smooth operation as the business grows.

Key takeaways

When creating and utilizing the South Carolina Operating Agreement form, several important points should be kept in mind. This document serves as a foundational element for your business structure and operations. Here are key takeaways to consider:

- Understand the Purpose: The Operating Agreement outlines the management structure, responsibilities, and operational procedures of your business. It helps clarify the roles of members and can prevent misunderstandings.

- Customization is Key: While templates are available, it is crucial to tailor the agreement to fit the specific needs and goals of your business. Consider factors such as member contributions, profit distribution, and decision-making processes.

- Member Contributions: Clearly define what each member is contributing to the business, whether it be capital, property, or services. This section helps establish ownership percentages and responsibilities.

- Decision-Making Process: Specify how decisions will be made within the company. Will it require a simple majority, or will certain decisions need a unanimous vote? This clarity can facilitate smoother operations.

- Dispute Resolution: Include a section on how disputes among members will be resolved. Whether through mediation, arbitration, or litigation, having a plan in place can save time and resources later.

- Regular Updates: As your business evolves, so too should your Operating Agreement. Schedule regular reviews to ensure that the document remains relevant and accurately reflects the current state of the business.

By keeping these points in mind, you can create a comprehensive Operating Agreement that serves as a solid foundation for your business operations in South Carolina.

Other South Carolina Templates

Hold Harmless and Indemnity Agreement - This document allows one party to avoid financial responsibility for the actions of another.

To facilitate the process of correcting or completing your vehicle title information, it is important to utilize the appropriate forms. If you're looking for a comprehensive list of necessary documents, you can explore All Missouri Forms to ensure you have all the required paperwork at your fingertips.

Kershaw County Register of Deeds - This form can be recorded with local property offices to update the public record.

Sc Dmv License Plate Return - This form provides the legal authority needed for someone to act on your behalf regarding your vehicle.