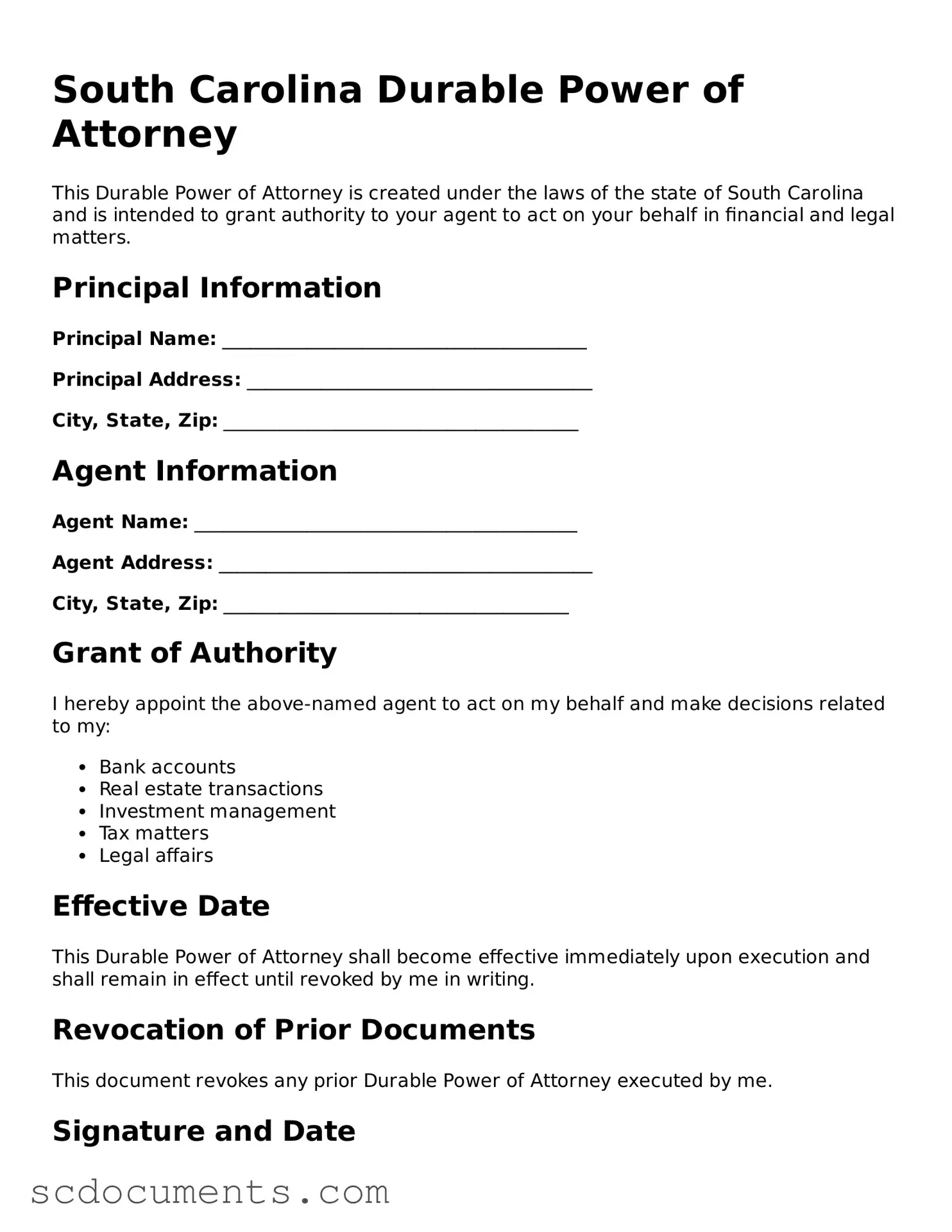

Legal South Carolina Durable Power of Attorney Form

Dos and Don'ts

When filling out the South Carolina Durable Power of Attorney form, it's crucial to approach the process with care. Here are some essential dos and don'ts to keep in mind:

- Do clearly identify the principal, the person granting authority.

- Do choose a trusted agent to act on your behalf.

- Do specify the powers you wish to grant in detail.

- Do sign the document in front of a notary public.

- Do keep copies of the signed document for your records.

- Don't leave blank spaces on the form; fill in all necessary information.

- Don't choose an agent who may have conflicting interests.

- Don't overlook the importance of discussing your wishes with your agent.

- Don't assume the form is valid without proper notarization.

- Don't forget to review and update the document as needed.

Taking these steps seriously can help ensure that your wishes are respected and that your affairs are managed according to your preferences. Act now to protect your future.

File Data

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make decisions on your behalf if you become incapacitated. |

| Governing Law | South Carolina Code of Laws, Title 62, Article 5, Section 62-5-501 et seq. |

| Durability | This type of power of attorney remains effective even if you become mentally incapacitated. |

| Agent Authority | The agent can handle financial matters, make medical decisions, and manage property, depending on your specifications. |

| Execution Requirements | The document must be signed in the presence of a notary public and two witnesses. |

| Revocation | You can revoke the Durable Power of Attorney at any time as long as you are mentally competent. |

| Limitations | Some powers may be limited based on your preferences or specific state laws. |

| Agent's Duties | The agent must act in your best interest and keep accurate records of transactions. |

| Common Uses | People often use this form for estate planning, healthcare decisions, or when traveling abroad. |

Documents used along the form

When creating a South Carolina Durable Power of Attorney, it's essential to consider other documents that may complement this important legal tool. These forms can help ensure that your wishes are respected and that your affairs are managed effectively, especially in times of need.

- Living Will: This document outlines your preferences regarding medical treatment in situations where you are unable to communicate your wishes. It specifies what types of life-sustaining measures you do or do not want.

- Hold Harmless Agreement: To protect yourself from liability, consider the legal aspects of the Hold Harmless Agreement template designed for various situations.

- Health Care Power of Attorney: Similar to a Durable Power of Attorney, this form designates someone to make medical decisions on your behalf if you are incapacitated. It focuses specifically on health care matters.

- Last Will and Testament: A will is a legal document that specifies how your assets should be distributed after your death. It can also name guardians for minor children and appoint an executor to manage your estate.

- Revocable Living Trust: This trust allows you to place your assets in a trust during your lifetime, which can then be managed by a trustee. It helps avoid probate and can provide for the distribution of your assets according to your wishes.

- Advance Directive: This document combines a Living Will and a Health Care Power of Attorney. It provides guidance on your medical preferences and designates someone to make decisions on your behalf.

- Financial Power of Attorney: While similar to a Durable Power of Attorney, this form focuses solely on financial matters, allowing someone to manage your financial affairs when you are unable to do so.

- HIPAA Release Form: This form allows you to authorize certain individuals to access your medical records. It ensures that your designated agents can make informed decisions regarding your health care.

By considering these additional documents alongside your Durable Power of Attorney, you can create a comprehensive plan that addresses both your health care and financial needs. Taking these steps now can provide peace of mind for you and your loved ones in the future.

Key takeaways

Filling out and using the South Carolina Durable Power of Attorney form is an important step in planning for your future. Here are some key takeaways to consider:

- Purpose: This form allows you to designate someone to make decisions on your behalf if you become unable to do so yourself.

- Agent Selection: Choose a trusted individual as your agent. This person will have significant authority over your financial and legal matters.

- Durability: The power of attorney remains effective even if you become incapacitated, which is a crucial feature of this document.

- Specific Powers: You can specify what powers you grant your agent. This might include managing bank accounts, selling property, or handling investments.

- Revocation: You can revoke the power of attorney at any time, as long as you are still mentally competent.

- Witnesses and Notarization: South Carolina requires that the document be signed in the presence of a notary public and two witnesses to ensure its validity.

- Review Regularly: It’s wise to review your durable power of attorney periodically, especially after major life changes, to ensure it still reflects your wishes.

Other South Carolina Templates

Generic Firearm Bill of Sale - This document generally outlines the terms of the sale, including any warranties or conditions.

To ensure a seamless process in correcting vehicle title information, it is important for individuals to utilize the appropriate resources available, such as the All Missouri Forms. This will help facilitate the proper completion of the Missouri 5177 form, thereby promoting clarity and accuracy in officially documenting vehicle ownership details.

Transfer on Death Deed South Carolina - Notify your beneficiaries about the existence of this deed to avoid confusion later.

South Carolina Employee Handbook Requirements - Provides a roadmap for addressing conflicts or issues among team members.