Legal South Carolina Bill of Sale Form

Dos and Don'ts

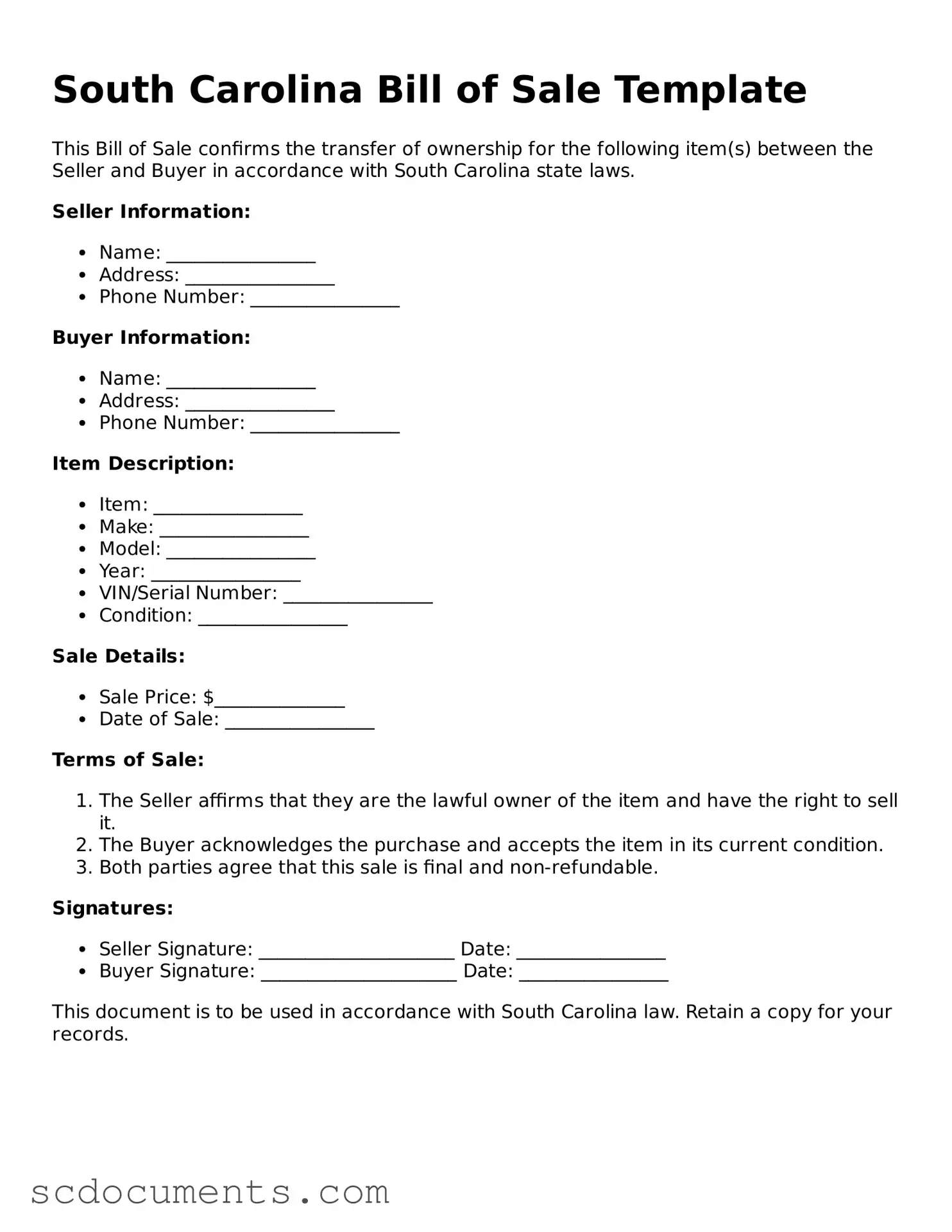

When filling out the South Carolina Bill of Sale form, it is important to follow certain guidelines. Here are four things you should and shouldn't do:

- Do include accurate information about the buyer and seller.

- Do provide a detailed description of the item being sold.

- Don't leave any sections blank; fill out all required fields.

- Don't forget to sign and date the form before submitting it.

File Data

| Fact Name | Details |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The South Carolina Bill of Sale is governed by South Carolina Code of Laws, Title 27, Chapter 23. |

| Types of Property | This form is commonly used for the sale of vehicles, boats, and other personal property. |

| Notarization | Notarization is not required for a Bill of Sale in South Carolina but may be recommended for additional legal protection. |

| Consideration | The document should specify the consideration, or payment, exchanged for the property. |

| Seller Information | The Bill of Sale must include the seller's full name and address. |

| Buyer Information | The buyer's full name and address must also be included in the document. |

| Description of Property | A detailed description of the property being sold should be included, such as make, model, and VIN for vehicles. |

| As-Is Clause | Many Bills of Sale include an "as-is" clause, indicating that the buyer accepts the property in its current condition. |

| Record Keeping | Both parties should retain a copy of the Bill of Sale for their records after the transaction is complete. |

Documents used along the form

When engaging in a transaction that involves the sale of personal property in South Carolina, several forms and documents can complement the Bill of Sale. These documents help ensure a smooth transfer of ownership and protect the interests of both the buyer and seller. Below is a list of commonly used forms that can accompany the Bill of Sale.

- Title Transfer Document: This document is essential for transferring the legal ownership of a vehicle or other titled property from the seller to the buyer. It provides proof of ownership and is often required by the Department of Motor Vehicles (DMV).

- Vehicle History Report: Particularly useful for vehicle sales, this report provides information about the vehicle's past, including any accidents, title issues, or odometer discrepancies. Buyers often request this document to make informed decisions.

- Odometer Disclosure Statement: Required for vehicle sales, this statement certifies the mileage on the vehicle at the time of sale. It helps prevent fraud by ensuring the buyer is aware of the vehicle's true condition.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment method, and any warranties or guarantees. It serves as a binding contract between the buyer and seller.

- Affidavit of Ownership: In situations where the seller cannot provide a title, this affidavit can serve as a declaration of ownership. It must be signed and notarized, affirming the seller's right to sell the property.

- General Bill of Sale Form: A critical document in personal property transactions, a legalformspdf.com helps in verifying the ownership transfer and protecting the rights of both seller and buyer, making it essential for a smooth sale.

- Inspection Report: For certain types of property, an inspection report may be necessary. This document provides an assessment of the property's condition, which can help the buyer make an informed decision.

- Power of Attorney: If the seller is unable to be present during the sale, a power of attorney allows another person to act on their behalf. This document must be properly executed to be valid.

- Tax Exemption Certificate: In some cases, buyers may qualify for tax exemptions on their purchase. This certificate provides proof of eligibility, helping to reduce the overall cost of the transaction.

Utilizing these forms and documents alongside the South Carolina Bill of Sale can streamline the process of buying and selling property. Each document plays a vital role in ensuring clarity, legality, and fairness in the transaction, ultimately benefiting both parties involved.

Key takeaways

When filling out and using the South Carolina Bill of Sale form, keep the following key takeaways in mind:

- Identification of Parties: Clearly identify both the buyer and seller. Include full names and addresses to avoid any disputes.

- Description of the Item: Provide a detailed description of the item being sold. This includes make, model, year, and any serial numbers.

- Purchase Price: Clearly state the purchase price. This amount should reflect the agreed-upon value of the item.

- As-Is Clause: Consider including an "as-is" clause. This protects the seller from future claims regarding the condition of the item.

- Signatures: Ensure both parties sign the document. Signatures validate the transaction and demonstrate mutual agreement.

- Date of Transaction: Include the date of the sale. This establishes a clear timeline for the transaction.

- Witness or Notary: While not always required, having a witness or notary can add an extra layer of legitimacy to the Bill of Sale.

- Keep Copies: Both the buyer and seller should retain copies of the Bill of Sale. This serves as proof of the transaction.

- State Requirements: Familiarize yourself with any specific state requirements. Certain items may have additional regulations or forms.

Completing the Bill of Sale accurately is crucial for a smooth transaction. Take the time to review all information before finalizing the document.

Other South Carolina Templates

Will in South Carolina - Creating a Living Will is a proactive step in reclaiming control over your health decisions.

For those seeking to understand the legal implications of a Hold Harmless Agreement, our guide will provide valuable insights and resources to navigate this important document effectively. If you want to access the template directly, visit our Hold Harmless Agreement template section.

How to Get Power of Attorney in Sc - You can revoke or change your Medical Power of Attorney at any time while you are competent.