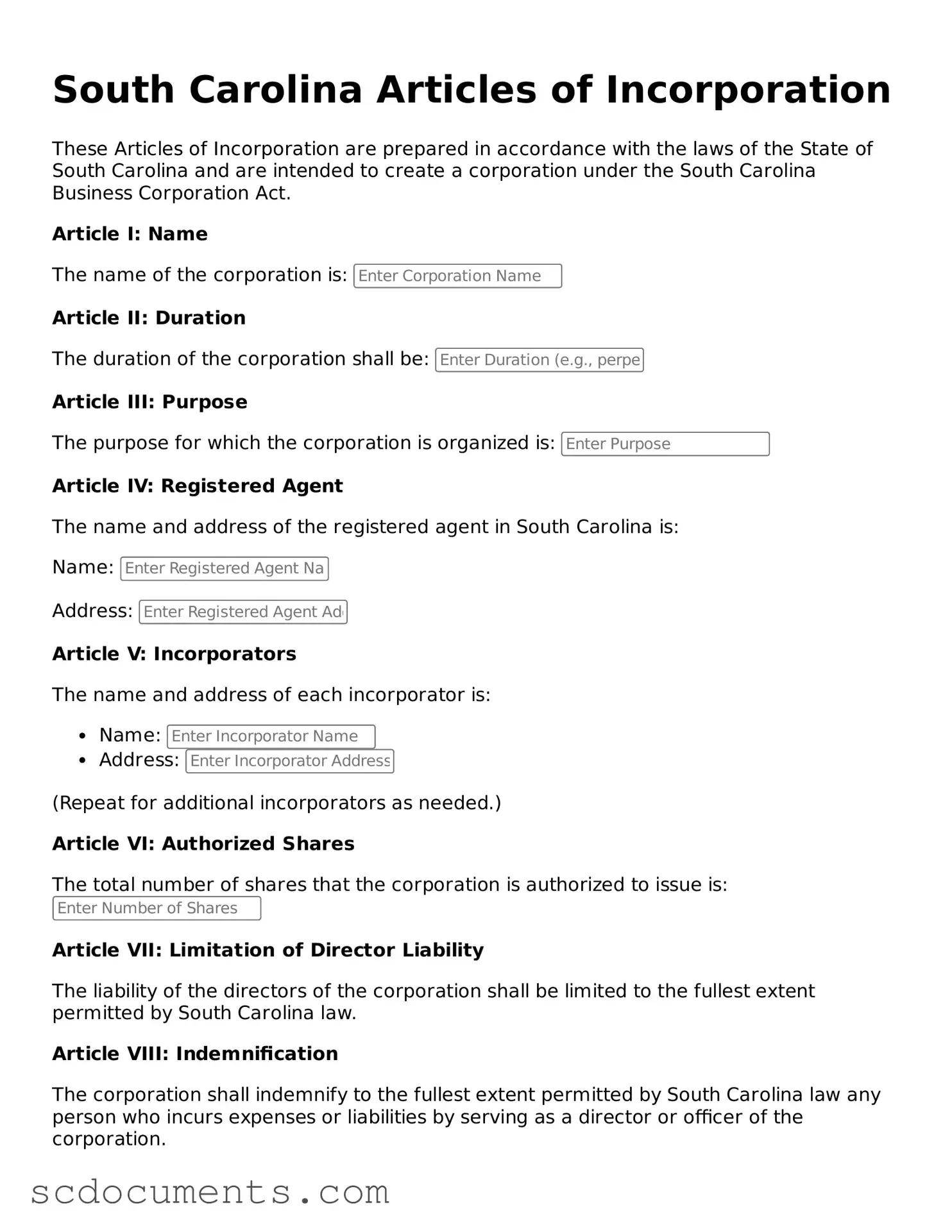

Legal South Carolina Articles of Incorporation Form

Dos and Don'ts

When filling out the South Carolina Articles of Incorporation form, it’s important to follow specific guidelines to ensure your application is processed smoothly. Here are five dos and don’ts to keep in mind:

- Do provide accurate and complete information. Double-check all entries for accuracy.

- Do include the names and addresses of all incorporators. This is a requirement for the form.

- Do specify the purpose of your corporation clearly. A well-defined purpose helps in understanding your business.

- Do sign and date the form. An unsigned form may lead to delays or rejection.

- Do pay the required filing fee. Ensure you check the current fee schedule to avoid issues.

- Don’t leave any sections blank. Incomplete forms can result in processing delays.

- Don’t use abbreviations unless specified. Clarity is crucial in legal documents.

- Don’t forget to keep a copy of the completed form for your records. This is important for future reference.

- Don’t rush through the form. Take your time to ensure everything is filled out correctly.

- Don’t submit the form without reviewing it thoroughly. Errors can lead to complications.

File Data

| Fact Name | Description |

|---|---|

| Governing Law | The South Carolina Articles of Incorporation are governed by the South Carolina Business Corporation Act, specifically Title 33, Chapter 1 of the South Carolina Code of Laws. |

| Purpose | This form is used to legally establish a corporation in South Carolina, outlining the corporation's structure and purpose. |

| Filing Requirement | To officially create a corporation, the Articles of Incorporation must be filed with the South Carolina Secretary of State. |

| Information Needed | Key information required includes the corporation's name, principal office address, and the name and address of the registered agent. |

| Duration | The Articles of Incorporation can specify a limited duration for the corporation or state that it is perpetual. |

| Share Structure | Details about the corporation's share structure, including the number of shares and their par value, must be included. |

| Incorporators | The form requires the names and addresses of the incorporators, who are responsible for filing the document. |

| Filing Fees | A filing fee is required when submitting the Articles of Incorporation, and the amount may vary depending on the type of corporation being formed. |

Documents used along the form

When forming a corporation in South Carolina, the Articles of Incorporation serve as a foundational document. However, several other forms and documents are often necessary to complete the incorporation process and ensure compliance with state regulations. Below is a list of key documents that you may encounter during this journey.

- Bylaws: This internal document outlines the rules and procedures for managing the corporation. It covers topics such as the roles of officers, how meetings are conducted, and how decisions are made.

- Initial Report: Some states require a report shortly after incorporation. This document provides basic information about the corporation, including its address and the names of its directors.

- Employer Identification Number (EIN) Application: This form, often called Form SS-4, is submitted to the IRS to obtain a unique identifier for tax purposes. An EIN is essential for opening bank accounts and hiring employees.

- Statement of Registered Agent: This document designates a registered agent who will receive legal documents on behalf of the corporation. It ensures that there is a reliable point of contact for legal matters.

- Business License Application: Depending on the nature of the business and its location, a local business license may be required. This application ensures that the business complies with local regulations.

- Shareholder Agreements: If there are multiple shareholders, this document outlines the rights and responsibilities of each party. It can help prevent disputes by clarifying ownership and decision-making processes.

- Missouri 5177 Form: This vital document is crucial for individuals seeking to correct or complete information on a vehicle title or certificate of ownership. For further details, please refer to All Missouri Forms.

- Annual Report: Many states require corporations to file an annual report that updates information about the business, such as its financial status and any changes in leadership. This report helps maintain transparency and accountability.

Understanding these documents is crucial for anyone looking to establish a corporation in South Carolina. Each plays a unique role in ensuring that your business is set up correctly and operates smoothly. By preparing these forms diligently, you can lay a solid foundation for your new venture.

Key takeaways

Filling out and using the South Carolina Articles of Incorporation form is an essential step for anyone looking to establish a corporation in the state. Below are key takeaways that can help streamline the process and ensure compliance.

- Understand the Purpose: The Articles of Incorporation formally establish your corporation and outline its structure, purpose, and operational guidelines.

- Choose a Unique Name: Your corporation’s name must be distinguishable from existing businesses in South Carolina. Conduct a name search to avoid conflicts.

- Designate a Registered Agent: A registered agent is required to receive legal documents on behalf of the corporation. This agent must have a physical address in South Carolina.

- Specify the Corporation's Purpose: Clearly state the business activities your corporation will engage in. This can be a general statement or more specific.

- Include Share Structure: Outline the number of shares the corporation is authorized to issue and their par value, if applicable. This information is crucial for potential investors.

- Identify Incorporators: List the names and addresses of the incorporators. These individuals are responsible for filing the Articles and setting up the corporation.

- Filing Fee: Be prepared to pay a filing fee when submitting the Articles of Incorporation. Check the latest fee schedule as it may change.

- File with the Secretary of State: Submit the completed form to the South Carolina Secretary of State's office. Ensure you follow the correct submission method, whether online or by mail.

- Obtain an Employer Identification Number (EIN): After incorporation, apply for an EIN from the IRS. This number is necessary for tax purposes and hiring employees.

By keeping these points in mind, you can navigate the process of incorporating in South Carolina more effectively. Each step is vital to ensure your corporation is set up correctly and legally compliant.

Other South Carolina Templates

South Carolina Prenup Contract - It fosters a culture of discussion around money and its impact on relationships.

When drafting legal documents, utilizing a proper Hold Harmless Agreement template can be crucial for protecting your interests. This essential form details the agreements made between parties to manage liabilities effectively. For further information, consider exploring the key features of a Hold Harmless Agreement.

Transfer on Death Deed South Carolina - The form provides a clear record of your wishes related to your property after your death.